|

(17 Nov 2008) The financial news of today was rather boring,

therefore I post only two items today (a military and one

financial).

Item 1) Scientific panel finds widespread

Gulf War I illnesses.

Item 2) Eliot Spitzer is not a girlie man upon the credit

crisis.

Item 1) Scientific panel

finds widespread Gulf War I illnesses.

This is news of a breath taking beauty: At

least one in four Gulf War I veterans have a lot of horrible

diseases related to the exposure of toxic chemicals. That are

about 175 thousand war veterans!

The best thing is: Lots of the sickness are

brain related! And compared to your brain, only a sickness related

to your penis is worse...;)

All day long, since I read that news, I feel

like I am walking on air. The only negative is: since they are war

veterans via the Veteran Affairs they have access to healthcare;

it would be even better that, since most of them cannot work, they

would not have health care. That's the way to deal with that slimy

military shit (mostly these are trailer trash people who enlist

the US military for the bonuses).

Let me quote a bit from this wonderful news (source):

WASHINGTON - At least one in four U.S. veterans of the 1991 Gulf War suffers from a multi-symptom illness caused by exposure to toxic chemicals during the conflict, a congressionally mandated report being released Monday found.

For much of the past 17 years, government officials have maintained that these veterans -- more than 175,000 out of about 697,000 deployed -- are merely suffering the effects of wartime stress, even as more have come forward recently with severe ailments.

“The extensive body of scientific research now available consistently indicates that ’Gulf War illness’ is real, that it is the result of neurotoxic exposures during Gulf War deployment, and that few veterans have recovered or substantially improved with time,” said the report, being released Monday by a panel of scientists and veterans. A copy was obtained by Cox Newspapers.

Gulf War illness is typically characterized by a combination of memory and concentration problems, persistent headaches, unexplained fatigue and widespread pain. It may also include chronic digestive problems, respiratory symptoms and skin rashes.

Comment: Needless to say why I feel so good

today! Quoting on, the best part is still to come:

It said that Acting Special Assistant to the Secretary of Defense for Gulf War illnesses Lt. Gen. Dale Vesser remarked that year that although Saddam Hussein didn’t use nuclear, biological, or chemical agents against coalition forces during the war -- an assertion still debated -- “It never dawned on us ././. that we may have done it to ourselves.”

Comment: This is so good; it never dawned

upon us... bla bla bla ...it to ourselves. It is now 17 to 18

years later than the first Gulf War!

And when will it dawn on the Americans that there could be a

little little fault in the official version of the 911 attacks

from 2001?

I guess; about 387 years (give or take a few decades)!

But what kind of stuff did they do to themselves? Quoting on:

Several soldiers interviewed said they were ordered to dunk their uniforms in the pesticide DEET and to spray pesticide routinely on exposed skin and in their boots to ward off scorpions. Others wore pet flea collars around their ankles.

Comment: In order to avoid scorpions, they

had to dunk their uniforms in DEET and spray pesticide over

exposed skin and it takes 17 to 18 years to get stuff like that to

the surface?

After AIG we know that the largest insurance company in the world

did not understand the basics of insurance, from the actions of

the Federal Reserve we know now that they do not understand what

it takes to maintain a fiat money system and we knew it already of

course but we have one more clue the Pentagon does not have what

it takes to fight wars properly.

The Americans are nothing more then a bunch of fatbag obese people

waggling through life without understanding much of it.

Lets close this item with a serious thing

(although I feel more like telling jokes):

I think for a long time that the USA going

nuclear at the end of World War II is a very important kernel of

what the American society is today. Today the USA is nothing more

than obese folks waggling around telling nonsense all day long,

but what explains this completely sung loose from reality?

I think going nuclear was one of those things, together with the

fact they were a super power (super powers never get corrected in

their ways of thinking so super powers are unstable

by definition) you have explained a whole lot of why they

are today what they are...

Item 2) Eliot Spitzer is

not a girlie man upon the credit crisis.

Remember Eliot Spitzer? He was the 54th governor

of New York and before that he was the main prosecutor trying to

keep Wall Street in line with legal reality. Beside being addicted

to attention (most of our political leaders and almost all of the

so called celebrities have an attention deficit disorder), he was

hooked on hookers.

An investigation into his financial

transactions lead to the discovery of a whore ring named 'Emperors

Club VIP' (see the Wikipedia

thing for more details).

So he is just like a real human being

although in almost all societies being a political leader and

fucking whores is often an unhandy combination...;)

Lets get serious, Eliot wrote an article for

the Washington Post (source)

and lets look at a little quote from that one:

And when the attorneys general of all 50 states sought to investigate subprime lending, believing that some lending practices might be toxic, we were blocked by a coalition of the major banks and the Bush administration, which invoked a rarely used statute to preempt the states' ability to probe. The administration claimed that it had the situation under control and that our inquiry was unnecessary.

Comment: It is a pity not a date & year

are given, but the fact that the Dubya regime claimed it 'had the

situation under control' is highly interesting because a lot of

other sources confirm that the Dubya regime has a lot to do with

subprime mortgages.

When empires start to fall there is always a

common factor: The leadership of that empire starts standing

outside reality, from the USA we know already for a long time that

their President Dubya has a strange world view. In Item 1)

from above you see the Pentagon is on the same way for a very long

time now. The debt hugging principles of the (Noble prize winning)

US economists are rather outlandish too & so on & so on.

So there is an enormous power vacuum out

there; the Europeans are not fit to fill it, the British have

their problems too, the Chinese are still too primitive, the

Russians get more clever by the year but their society is far from

ready...

What will fill this giant power vacuum? Next

US prez Obama?

We'll see how stuff pans out, till

updates!

(16 Nov 2008) This day I don't want to talk about hobby's like

trying to destroy stock markets or attacking the funding base of

the US military.

No today I don't feel like talking about

hobby's, I feel like talking on the more serious matters in life.

How can you have hobby's when the basics in your life are a

disaster?

Therefore I would like to post a few video's

as found on the YouTube website, they range from how to fold a

tshirt in two seconds, more efficient making a tie in your

shoelaces to brewing beer.

My dear reader might think 'brewing beer'???

And what about that Muslim and mujahedin stuff? Well I am rather

serious on that: I think it is better Muslims brew their own

beers. Not those heavy ones that make you drunk, loose your self

control and you get aggressive to your family for example.

No, once you understand the rather subtle details of brewing you

can easily brew so called 'table beers' that are so light you

cannot get drunk from them but still are very tasty.

In the picture below you have six video's,

number 1 and 2 are about the folding of tshirts, number 3 and 4

about efficient shoelace tying, number 5 is about the important

subject of how to fold your socks and in video number 6 some

basics about beer brewing are explained. (In case you want to make

beer, start with a soup pan and malt extract and most of all: buy

a good book first or get it from the local library.)

So these are the important things in life;

when the important things are on order you can indulge in hobby's

like destroying the US financial system. Nothing of importance is

found over there, so only a hobby can bring it down.

Till updates!

(14 Nov 2008) Only three items:

Item 1) Very funny YouTube video about a guy

named Peter Schiff.

Item 2) Everybody is talking about a successful test of the 8000

DOW low...

Item 3) US Treasury Secretary Paulson is debiting deep insights.

Item 1) Very funny YouTube

video about a guy named Peter Schiff.

A guy named Peter Schiff (he is an American)

did see a lot of the present troubles coming and in the YouTube

video you can see how a lot of other Americans try to put him in

the category of 'rotten fish'.

The oldest date in the video was something

out 2006, so Peter is good but I remember that in the spring of

2004 I was very worried for a few days. Wow wow wow, I am not

scared easily but the sheer size of the clearly impending crash

did even send shivers down my spine...

All in all it goes very good, food and oil

prices are coming down so that horror scenario is prevented for

the time being...

Have fun looking at the video, it is about 10

minutes long:

http://www.youtube.com/watch?v=2I0QN-FYkpw

Item 2) Everybody is

talking about a successful test of the 8000 DOW low...

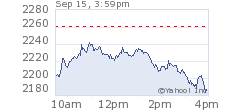

Yesterday the DOW Jones breached the 8000

level, after that it jumped up over 10% (the largest dead cat

bounce in this second activation of the NightmareOnWallStreet).

Some observers remark this can only be the work of the Plunge

Protection Team because normally speaking after breaching 8000 a

lot of automatic selling would be there.

But most Americans talk about a successful

test of a new low (thus implicating there is no problem).

You can choose what they have in their

head:

1) Horse shit,

2) Cow diarrhea,

3) Rabbit shit,

4) Alzheimer's disease, or

5) A healthy and properly working brain...

Let me select only one small detail why it

cannot be number 5).

Begin small detail:

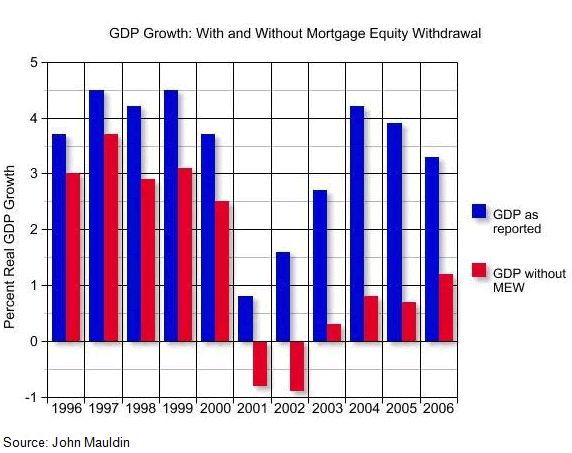

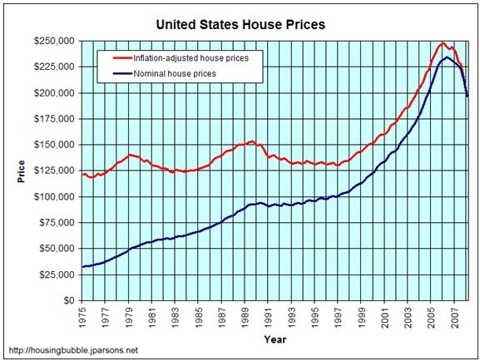

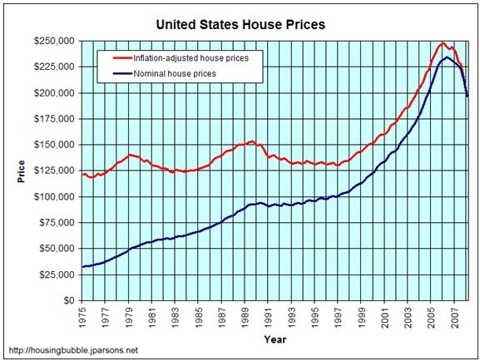

Right now the house price deceleration is

still picking up speed; the year on year declines are still

growing every month.

That means we are still not halfway.

The first half of the house price decline will bring less pain

than the second half.

Right now about 18% of US houses are 'under water', that means

they have more mortgage than the value of their house.

So when house prices are on their long term affordability

again, it could very well be that 50% of all houses have a

mortgage higher than the actual value of the house.

End small detail.

Funny to observe all those Americans talking

about a successful test of the DOW Jones 8000 level, I think their

future mental span is about 24 hours...

Item 3) US Treasury

Secretary Paulson is debiting deep insights.

On Yahoo finance (who have it from the fools

at CNBC) a very remarkable quote was found from the Paulson clown,

(source)

quote:

Government purchases of capital in healthy banks are likely to restore lending, he said.

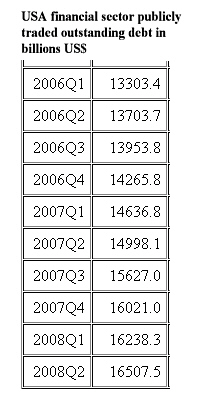

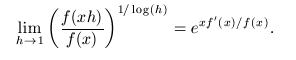

Comment: We clearly see that the clown

Paulson is trying to get the old ways of picking up more debt once

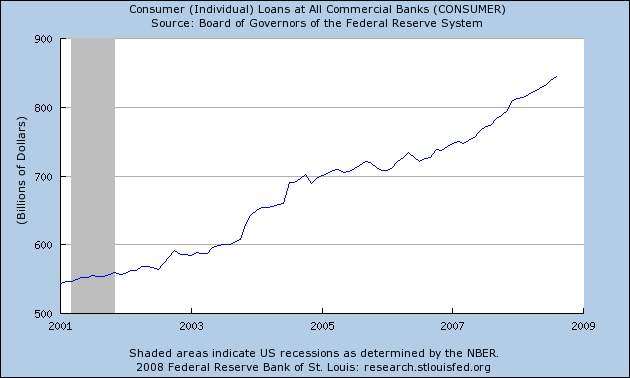

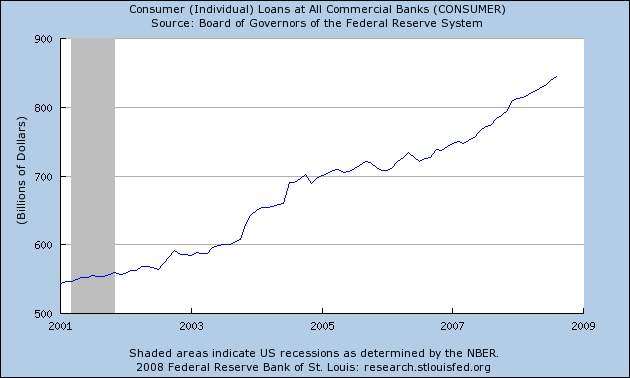

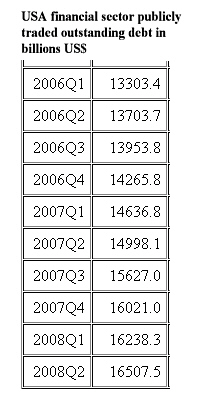

more to the surface. But as I calculated for my honorable

audience, the US financial sector picked up debt in the period

1974 - 2008 with a speed of 13% year on year.

At 01 July 2008 the debt of the US financial sector stood at

16507.5 billions of US$.

That is above the entire US gross domestic product and although in

the last seven years it is only about 9% year on year growth,

lately the entire sector is picking up historical levels of more

debt.

The US main stream financial media make a big

fuss if government debt is standing at 9 or 10 trillion, they

'forget' to mention the 16.5 trillion beast that is still growing

in double digit numbers.

In case you missed it: go to the 11

Nov update in the Nightmare files.

Till updates.

(13 Nov 2008) This update is boring because any idiot can see

the next G20 meeting will fail, so shy should I hit the button

'publish website' anyway?

Item 1) Why the 15 Nov G20 nations meeting

will fail.

Item 2) Jesse found a 2x2 cross table on inflation &

deflation.

Item 3) Super perfect US Oct Federal deficit: $237.2B

Item 4) A nine page read: The end of the Wall Street boom.

Item 5) As usual the empty item.

Item 1) Why the 15 Nov G20

nations meeting will fail.

Really I do not understand what is in the

mind of the other 19 nations of the G20 but we, the public, are

supposed to believe that our political leaders will 'work

together' and 'make progress' on the financial crisis that is a

severe thread to the global economy.

I really do not understand this, may be the

Central Banks of the other 19 nations still have too much US

Treasuries on their balances and they get spooked by the idea that

that stuff is in fact total crap.

Let me keep this simple and easy to

understand:

The G20 nation meeting will fail because it

is done under the leadership of US prez Dubya. Just like there is

zero point zero progress in the promised Palestine state (two

nations living in peace together) this all will bring only photo

shots of dumb political leaders. Nothing will happen...

In fact the US Paulson clown has already pointed at some of the

problems they cannot be blamed for: There are nations that save

too much and do not consume enough, countries like China or those

oil producing countries just do not consume enough and you cannot

hold the USA responsible for that... (No source files given, but

that is the beginning reasoning of the USA.)

Item 2) Jesse found a 2x2

cross table on inflation & deflation.

My compliments go to Jesse because he started

me thinking on money supply inflation/deflation versus the

behavior of asset price inflation/deflation.

I never looked at it in this way because the

Central Bankers will always find some lousy excuse to inflate

because they think that is 'best for the economy'. For example the

European Central Bank has almost never met

her official target of consumer inflation below 2%, they always

have lousy arguments year in year out why the rates should be that

low...

Here is his link from Jesse's Café

Américain:

Nailing our Thesis on Inflation and Deflation to the Door

Item 3) Super perfect US

Oct Federal deficit: $237.2B

And when year in year out you have the

value of your fiat money too low via idiot low interest rates, you

inevitably get one of those pinched in your dumb face:

October budget deficit hits record of $237.2B

More of that will follow, there is so much

fun to be found in the USA shadow banking system but rather likely

the G19 idiots have never heard of a shadow banking

system...

Item 4) A nine page read:

The end of the Wall Street boom.

A long read from Portfolio dot com, nine

pages to be precise. I stopped reading after three pages because

there was nothing new in it.

But for financial amateurs like G20 political

leaders it is a good read:

The

end of the Wall Street boom

Item 5) As usual the

empty item.

It is a good thing I always shave my head so

I am bold already. When I think of these idiots that go down to

the G20 meeting under the leadership of Dubya and his clown US

Treasury deputy Paulson I would tear all my hear out.

These G20 idiots; What is in their

brains?

Emptiness, only emptiness will be found

there...

Till updates.

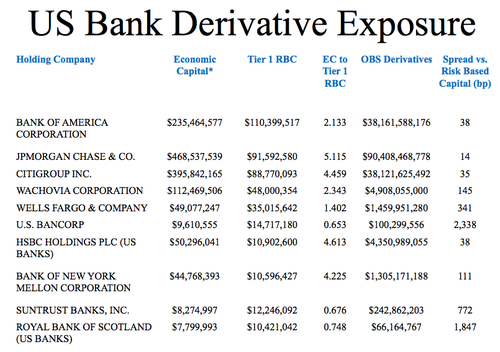

(12 Nov 2008) This is a multi trillion update, without any

derivative positions mentioned this is the biggest multi trillion

US$ & € ever posted.

Topics ran widely from large to small countries and there are not

five but seven items.

Item 1) Prudent Bear: Guest commentary on the

US 2009 bond market.

Item 2) US M2 money growth: The FED does not understand basic

math.

Item 3) The one year anniversary of the NightmareOnWallStreet, a

chart.

Item 4) A nice graph from David Merkel.

Item 5) Why Bailouts Attract Handout Seekers (from Barry's

hangout).

Item 6) Naked Capitalism on Iceland.

Item 7) The empty item.

Item 1) Prudent Bear: Guest

commentary on the US 2009 bond market.

This is already the third link I post to one

of those guest commentaries; often they are very good in depth,

width and originality. The writer of the commentary, Martin Hutchinson,

is just like me expecting real bad weather for the bond markets in

2009. Now the credit crisis is more and more unfolding in her

majestic beauty, only new US government bonds reach staggering

numbers.

But you can find a lot of those numbers in

the commentary, lets do the quoting thing (source

& Prudent Bear home

page):

With M2 money supply (the one the Fed will divulge) up at an annual rate of 18.3% since the beginning of September it seems likely that inflation will accelerate – as it did in the recessions of 1973-74 and 1979-80.

Comment: This speed is new to me and we can

only estimate what happens to the broadest measure M3 because the

US Federal Reserve does not report that any longer (the costs are

too high compared to the economical insights gained... FED source).

Don't forget: The broader the money measure the faster it grows

and these now countless trillions of M3 money can damage the M1

only you have in your wallets...

Item 2) US M2 money

growth: The FED does not understand basic math.

Suppose you have a savings account with a

fixed starting amount and in the first year you get 5% interest,

in the second 10% and in the last year 15% interest.

I have two questions for you:

Question 1) Is your average interest 10%

(since that is the average of the numbers 5, 10 and 15)?

Question 2) Does the order make any

difference? So does the 5, 10, 15% sequence give the same results

as the 15, 10, 5% sequence?

Stuff like that belongs to the very basic

math of financial calculation, on question 1 you must take the

geometric mean of the numbers 1.05, 1.10 and 1.15 resulting in

1.0992... Hence the average grow factor is 1.0992 and thus the

average percentage is 9.92%.

As a rule of thumb you can neglect the

difference because it is so small, but if a student on an exam

would say it is 10% I would draw my red pencil and the student

would have zero points for that answer.

These days we have 8 € hand calculators

like the Casio fx-82 so there is no need for the rule of thumb any

longer. (In the past you needed logarithm tables and too much time

to arrive at the correct answer, hence the rule of thumb made

sense.)

Now we turn to the Federal Reserve H6

Statistical Release (about money supply). The current release is

from 06 Nov (source),

cut and paste quote on M2 money supply:

June 2008: 7638.7

Sept 2008: 7769.0 (both billions of US$).

Comment: In a period of 3 months this grew

7769/7638.7 = 1.01705.... or 1.705...%

If you make a full year of that (that means annualizing it) you

get 6.9997...% or 7.0% for simplicity. What does the FED make of

it? Quote:

3 Months from June 2008 TO Sep. 2008:

6.8%

Comment: You freakin don't believe this; at

the FED they cannot even compound a steady interest rate! Even

with the modern technology they fail on details, just like their

car factories that complain since the mid nineties about foreign

cars but did absolutely nothing, just nothing, about that.

Why do so many economists still tell crap like 'The US economy is

very adaptive'? Why, in Gods name why?

These are only obese fatbags doing their daily routine...

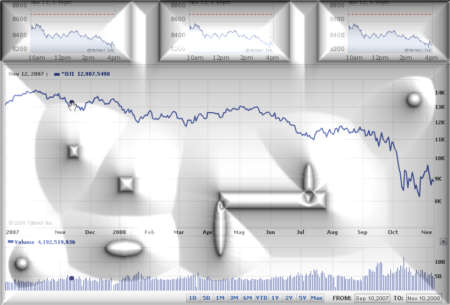

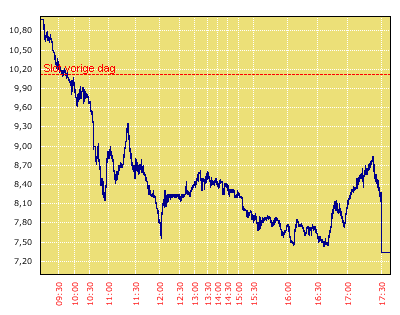

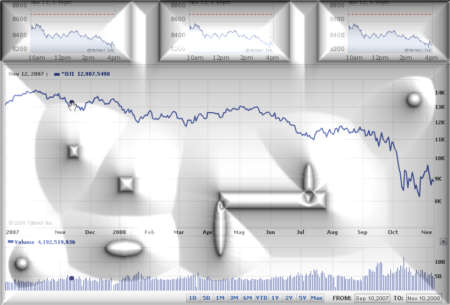

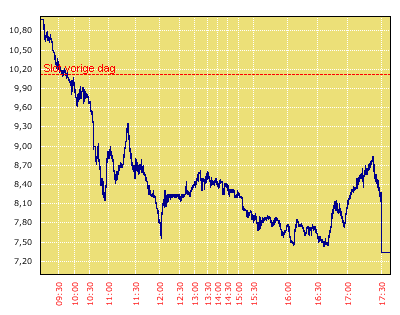

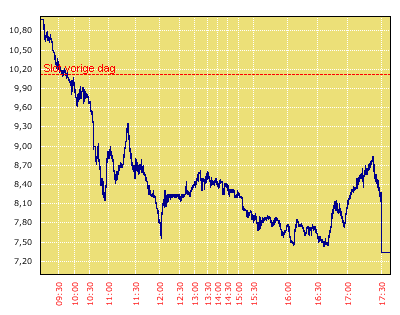

Item 3) The one year

anniversary of the NightmareOnWallStreet, a chart.

One year ago when I did the second activation

of the NightmareOnWallStreet, the DOW stood at 12,987.5498 after

flirting a bit with the 14 thousand level just a few weeks before.

Only a chart of the last 14 months, click on

the picture for a wider version (I have included today's DOW

chart):

Today the DOW ended at 8282.66 points, not

bad & for the rest no comment.

Item 4) A nice graph from

David Merkel.

On Seeking Alpha David has a nice chart about

total US debt versus gross domestic product. Until now this was

mostly done for small countries, the main stream media truly has

no problem with publishing stuff like this for small neglectable

quantities...

According to David the US economy has now

about 356.5% in direct debt outstanding, this is without jokes

like the US Treasuries in the Social security funds. That makes

stuff only worse.

David's main point of reasoning is that the

actions of the US Federal Reserve are only helping those parts of

the US economy that still are capable of absorbing more debt.

That is a relatively good take of the present

developments.

The last thing we can say about the Americans is that they behaved

as responsible house fathers with regard to the world reserve

status of the US$. They really thought this was all for free...

Seeking Alpha source.

Graph source.

Item 5) Why Bailouts Attract Handout Seekers

(from Barry's hangout).

Only a quote around the sudden arise of all

kinds of new banks in the USA (hey who said they do not have a

vibrant economy?). New banks everywhere because there is taxpayer

money to hand out... Quote (source):

A truisim of all bailouts: Enormous amounts of taxpayer cash attracts all manner of unsavory, undeserving characters. What was supposed to be a narrow and limited attempt to reduce the systemic risk of a financial collapse has become a taxpayer funded free-for-all.

Like hyenas trying to steal the kill from a lion, the mere scent of this enormous pile of loot starts attracts the scavengers. They cannot help themselves, for it is their essence, and who they are.

Comment: Barry observes that at the present

rate grow of handing out money the price tag could be 8 to 10

trillion US$ or even an entire GDP.

For me that is not relevant, all I know is that the US military

costs about 700 billion US$ a year and that is the only funding to

destroy as far as I am interested...

Item 6) Naked Capitalism on

Iceland.

Only a funny quote from a long article on the

Iceland stuff (source):

Iceland’s banking system is ruined. GDP is down 65% in euro terms. Many companies face bankruptcy; others think of moving abroad. A third of the population is considering emigration. The British and Dutch governments demand compensation, amounting to over 100% of Icelandic GDP, for their citizens who held high-interest deposits in local branches of Icelandic banks. Europe’s leaders urgently need to take step to prevent similar things from happening to small nations with big banking sectors.

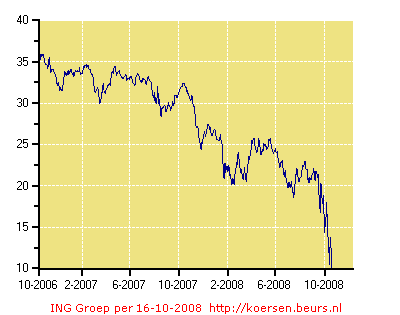

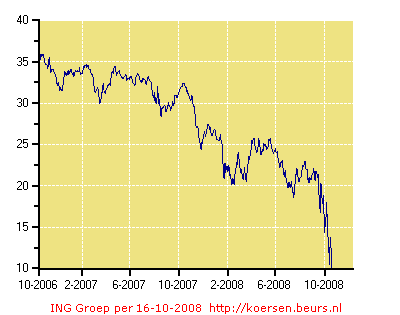

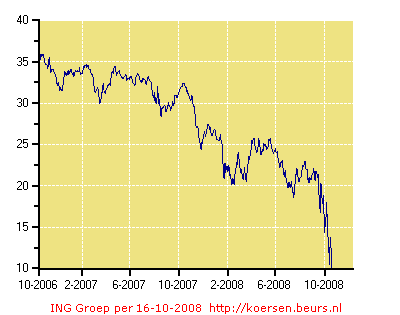

Comment: Well I know of a few of those

countries, for example Luxembourg is almost entirely dependent on

banks and what to think of my own country the Netherlands? The ING

bank has so called 'assets' on her balances that are as wide as

300% of our gross domestic product...

Until now I still consider ING a large liability to the Dutch

society and not a large asset. But facts are facts and today it

was reported ING sucked in 7 billion € in new savings from the

population... (The only problem: The population does not know how

banks work, they go for the slogans and the advertisements.)

Item 7) The empty

item.

Empty empty & more emptiness... Think for

yourself please!

Till updates.

(11 Nov 2008) It is now day 365 of the second activation of the

NightmareOnWallStreet. It was activated for a second time just

after the 14 thousand top of the DOW Jones stock index.

I sincerely hope the US economists have

gained wisdom in the last 12 months, I only have hope because in

fact these fake scientists also have their own 'emotional

resistance levels'.

Lets make a long story short and explain to

US economists why their entirely economy is doomed and they can

ponder the question why they are not free academics but only ass

licking cleaners of the debt huggers.

American economists being a help for

humanity?

These perfumed princes are not worth their salary...

Simply look at the last update in the

nightmare files & conclude they are not worth their salary:

11 Nov 2008 US

financial sector: Debt growth through the decades

Till updates.

(10 Nov 2008) The five items for today:

Item 1) Trashed US economist of today: Nobel

prize winner Paul Krugman.

Item 2) Dubya, I already start missing him...

Item 3) How to make a profit of just 5455% in just a few months.

Item 4) AIG: The gift that keeps on giving.

Item 5) The empty item.

Item 1) Trashed US

economist of today: Nobel prize winner Paul Krugman.

I keep on wondering why this guy got the

Nobel prize, ok ok it is long known that the economy Nobel prize

is more or less an incestual happening but even then it might be

expected the winner has some kind of real brains.

So not saint Paul; instead of analyzing why

all those fake Federal Funds filled with Treasuries only maximize

a Federal default, or instead of pointing to the debt the combined

US financial sector has upon itself, our Donald Duck of economics

writes (source):

Well, there’s no question that fighting the crisis will cost a lot of money. Rescuing the financial system will probably require large outlays beyond the funds already disbursed. And on top of that, we badly need a program of increased government spending to support output and employment. Could next year’s federal budget deficit reach $1 trillion? Yes.

But standard textbook economics says that it’s O.K., in fact appropriate, to run temporary deficits in the face of a depressed economy. Meanwhile, one or two years of red ink, while it would add modestly to future federal interest expenses, shouldn’t stand in the way of a health care plan that, even if quickly enacted into law, probably wouldn’t take effect until 2011.

Comment: When after the ravages of war a

country can always pick up debt because it is clear it will pay

itself back with a factor far above the number one. Given the debt

levels throughout the entire US economy, from the Federal to the

household level you can safely conclude more debt will not work.

The standard textbook simply does not take into account that

interest on outstanding debt is already above total profits of the

entire economy. Our Donald Ducking Paul Krugman forgets to mention

this little detail...

Therefore Paul Krugman is classified as a 'debt

hugger'.

Item 2) Dubya, I already

start missing him...

I already start missing him, Dubya is one of

the items you only miss after he is gone. Gone are the theories

that less tax now means more tax revenues in the future. Gone are

theories that a low minimum wage is best for the economy (while

outsourcing the industry). Gone are the statements that freedom is

on the march in Iraq...

It is all gone, there will be a vacuum so

big, it dwarfs the universe...

Luckily on biertijd dot com there are some

photo's left.

Click on the picture to view them & understand the deep deep

loss we have!

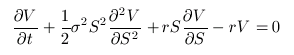

Item 3) How to make a

profit of just 5455% in just a few months.

Profits like the above look huge but a return

of 54.55 times your investment is simply needed to fund al lot of

these kinds of investments.

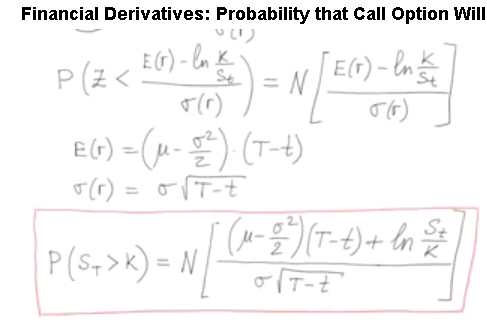

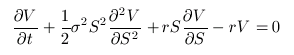

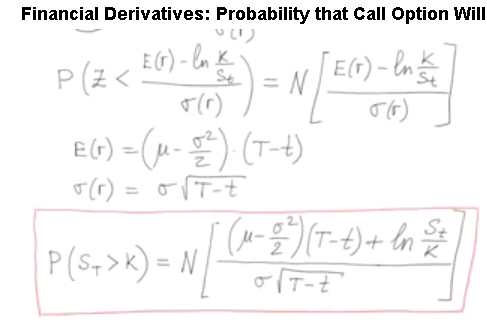

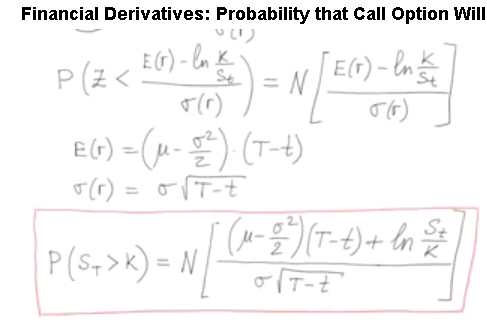

It is very simple: all you need to know that the pricing of

options mechanism fits most of the time but not all of the time.

There is a deep and fundamental flaw in the pricing of options, I

know that over a decade and I am still poor and unemployed. When I

apply for a job at a bank or a pension fund, my capabilities are

always not needed.

So for the time being I am destroying entire

banks and entire pension funds, why not? It is very funny to do

and nobody dies from it.

On Seeking Alpha they have an article about

Nassim Taleb, Nassim and me have remarkable similar insights when

it comes to rare events. To be honest: Nassim is even better

because he advises a multi million US$ thing...

All I want is military power, the more the

better and these days you cannot buy real military power with

money.

Lets quote a bit of the fun (source):

Universa keeps 90% of its assets in cash or cash equivalents and simply tries to break even as it places small bets on rare events.

Five weeks ago when the S&P 500 was trading around 1200, Universa bought S&P 500 Index put options with a strike price of 850, due to expire late October. They were betting an “unlikely” drop would occur.

They paid around 90 cents for those options. By Oct. 10, the S&P had dropped 300 points in a month. The options Universa purchased for 90 cents were now trading for $60 each. Universa cashed out of its position around $50, good for a gain of 5455%.

Universa also paid $1.29 for a put option on the insurance company

AIG. They’d be in the money if AIG dipped fell below $25 a share by September. AIG

(AIG) imploded in a tangle of bad debt and Universa sold the AIG put options for $21 apiece.

Comment: Not bad, these days you can do the

same thing on the currency markets & the more volatility there

is the better it gets. The idea is so simple: Pick up far far out

of the money stuff when the sellers of that stuff think it is

ruled by their computer program and cash in every few times in a

decade or so.

Item 4) AIG: The gift that

keeps on giving.

It is so lovely: By the week more and more

expensive it gets for the US tax payer and we must not forget that

most Americans hang on to the next insight:

Taxing people

= Stealing jobs.

Government jobs are often low paid because of

the job security that comes with it, but Americans think that

taxes steal jobs. Taxes bring also law enforcement but they never

say:

Law

enforcement = Stealing jobs.

They are so dumb, you just cannot imagine how

dumb they are.

But every now and then there is one of those

Americans that is not entirely dumb and gets mad about what is

happening with tax payer money in the case of AIG.

AIG, for me the gift that keeps on giving.

Here is the link where someone named Yves Smith rants against Wall

Street advertisement outlet the Wall Street

Journal:

AIG: The Looting Continues (Banana Republic Watch)

Comment: AIG, the gift that keeps on giving

for a long time to come!

Item 5) The empty

item.

Empty empty empty.

Not empty enough? Check it out where the

Federal Reserve declines to shed light on her two trillion in

taken in garbage collateral:

Fed Defies Transparency Aim in Refusal to Disclose

Till updates.

(09 Nov 2008) Only one item today:

Item 1) Two Little-Noted Features Of The Markets And The Economy.

Item 1) Two Little-Noted Features Of The Markets And The Economy.

My dear reader, I hope that by now it is well

known I only use the financial crisis and the economical troubles

flowing from that as an 'investment vehicle' to destroy the US

military might.

Let there be no doubt about my intentions: I

want to destroy the US military might.

For this to happen, tactical stuff like

impossible funding of the US military future dreams are important.

Until now everything goes perfect; for example the largest

insurance company in the world named AIG is perfectly hooked to

the wallets of the US taxpayer. A lot more is already hooked to

the US taxpayer mouth and in the future a lot more will be hooked

in order 'to preserve the system'.

In my little fishbowl of reality everything

worked just fine; all stuff simply worked together to bring down

the US military might.

The US of A is also the best 'weapon smith'

around, regardless of the financial troubles they will always take

pride in their weapon systems crafted...

I will not attack this pride but only the

stuff it leads to: Dumb political leaders having too much military

powers is what we need to kill.

Now back to the title of this item:

The writer of the article that shook my

foundations in bringing down the US military is a guy named Peter Bernstein.

He is 89 years of age and so he is about double my age. Peter has

wisdom to share, it made me do a rethink of destroying the US

military might...

His graphics are from the stone age, may be

this explains why they are so good.

Click on the picture for the entire

article:

Peter has a good point in asking why bond

yields are above stock yields because stocks carry much more risk

compared to bonds...

After my humble opinion the impending crash

on US government bonds could lead to restoring the power of the

bonds. I am fully aware of the fact that a lot of players still

think US government bonds are the safest place to be; let them

think what they think...

Till updates.

(07 Nov 2008) The five items of today:

Item 1) US non-farm payrolls & is there a

party starting?

Item 2) US states unemployment funds running empty?

Item 3) Handy for in your bookmarks.

Item 4) Military stuff: Russian missiles in Kaliningrad.

Item 5) The empty item.

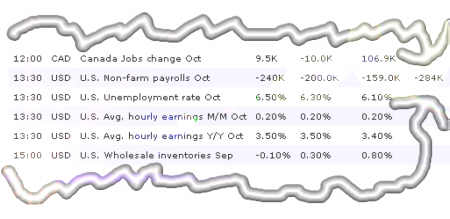

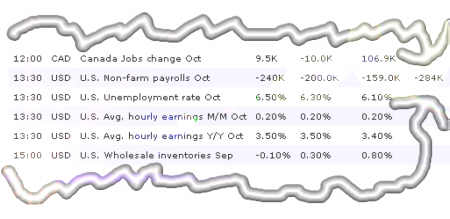

Item 1) US non-farm

payrolls & is there a party starting?

Very good news from the non-farm payroll

front: In Oct the US economy shed 240 thousand jobs and if that

was not good enough, the month of Sept was revised from 159 to a

loss of 284 thousand!

So we have at least 240 + 284 = 524 thousand

shed jobs in the last two months but likely it is even better!

Almost always the 'revision' in the NFP shows lesser jobs, never

more. That has nothing to do with a 'conspiracy theory' but with

the fact a lot of unemployment simply is not processed when the

figures come out.

The revision for Sept was 284 - 159 = 125 thousand.

Therefore Oct could be as high as 240 + 125 = 365 thousand lost

jobs...

Needless to say this is good news for me and

believe it or not, it is good news for the US stock markets too

(at the moment of writing the DOW is up 2.39%).

Here is a picture, click on it for the source

file:

Item 2) US states

unemployment funds running empty?

In the USA the states run the unemployment

trust funds, from the Federal funds we already know there is no

real money in it but only US government bonds (that keeps the

official deficit low). So all real money that was supposed to be

in the Federal funds is already gone and spend on pet projects

like war or roads to nowhere.

Today I came across an article that says the

unemployment funds from the states are running empty, it just

looks like these are funds with real money from employers in it.

Let me (Yahoo/CNNmoney source)

quote:

"Some states didn't have adequate reserves built up," said Andrew Stettner, deputy director of the National Employment Law Project. "They are having significant problems paying out the increased number of benefits."

Comment: This looks like a fund with real

money in it, but has it? Quoting on:

The Michigan fund is being squeezed, in part, because of changes lawmakers made over the past 12 years, Geskey said. When times were good -- the fund had a $3 billion balance in 2001 -- officials lowered the tax rate. This resulted in a loss of $1.1 billion in contributions, he said.

Comment: Here in Holland there is always real

money in such funds and during good times the unemployment tax is

always kept high for a long time. So next year, now the economy is

turning bad, we don't have to pay for a full year in unemployment

tax.

Again: A fiat money system can only be stable and long lasting

when there are enough reserves on all kind of levels of the

society, the American economists are too plain stupid to

understand that trivial detail.

Here is a link to the US Treasury Unemployment Trust Fund Report Selection.

http://www.treasurydirect.gov/govt/reports/tfmp/tfmp_utf.htm

When you click on one of the state reports

you see there are 'shares/par' in it, that does not proof there is

no real money in it but indeed it is a strong clue that all

unemployment taxes are long gone by now. (And replaced by

'shares/par' that can be sold to the US Treasury.)

Item 3) Handy for in your

bookmarks.

The next link is a search link on Bloomberg

dot com, it is a function crafted by Bloomberg and it is named

WDCI. I do not have a clue what it means exactly but likely it

stands for 'Write Downs & Capital Injected' or similar stuff.

The function measures total write downs and

capital raised by the 100 largest banks in the world. The link I

have is not updated very often; the latest update from 29 Sept

says 590.8 billion US$ in write downs and 434.2 in new capital

raised (from rather dumb investors I just guess).

Here is the search link:

http://search.bloomberg.com/search?q=WDCI&site=wnews&client=wnews&proxy

stylesheet=wnews&output=xml_no_dtd&ie=UTF-8&oe=UTF-8&filter=p&getfields=

wnnis&sort=date%3AD%3AS%3Ad1&submit.x=14&submit.y=5

And here the latest (29 Sept) result:

Banks'

Subprime-Related Losses Surge to $591 Billion: Table

Remark that after my estimations the US banks

have used the 'mark to market' rule to write down on their own

debt obligations to the tune of over 200 billion US$. So in theory

this number should have been above 800 billion US$ but the main

stream media prefers, just like the case is with hidden Federal

debt, to hang on to their version of Alice in wonderland.

That's fine by me: Just another profession that does not

understand the basics of her own profession.

It's as simple as it is; Those who tell crap only render

themselves into insignificance...

Item 4) Military stuff:

Russian missiles in Kaliningrad.

For a few days I waited before commenting on

this military detail, I waited to see if there was any Western

'political observer' or 'commentator' finally stating it makes not

much sense to build an anti missile shield in Poland.

The Americans give help to Israel with a radar post to detect

early missiles from Iran but the anti missile shield is located in

Poland...

It makes me wonder; why does nobody wonder?

A long quote from the International Herald

Tribune (source):

The French presidency of the European Union expressed "strong concern" Friday over a Russian plan to station new missiles near Poland's border.

Russian President Dmitry Medvedev announced Wednesday that Moscow would deploy missiles in its western outpost of Kaliningrad in response to U.S. plans to station an anti-missile defence shield in Poland and the Czech Republic.

"The presidency of the European Union council expresses its strong concern after the announcement by President Medvedev ... of the deployment of a complex of Iskander missiles in Kaliningrad," the presidency said in a statement.

"This announcement does not contribute to the establishment of a climate of trust and to the improvement of security in Europe, at a time when we wish for a dialogue with Russia on questions of security in the whole of the continent," it said.

The Bush administration says its missile shield aims to protect its European allies against possible attack by "rogue states," particularly Iran, and by terrorist groups. Moscow views the system as a direct threat to its national security.

Comment: It is about high time the European

political leaders get their heads out of their perfumed asses. If

this anti missile shield truly was for protection against 'rogue

states' and terrorist groups (since when have terrorist groups

long range missiles by the way?) why locate it in Poland? Would

the brave nation of Israel not make much more sense to place such

a anti missile shield?

The European political leaders have not addressed the above

questions and by telling crap they create a so called 'power

vacuum'. That's not very smart after my humble opinion, remember

in the Georgian equation it was the same and the outcome of that

was also a consequence of having your head too deep inside your

perfumed asses.

To Russia: Placement of missiles is allowed but there are some

rules in this:

Leave all nuclear stuff out, so preferably missiles that cannot

transport nukes anyway (I have little to no insight in your

missiles so I do not know how realistic this is). For the rest,

number of deployed missiles: 300 to 400 is no problem from my side

of the equation.

You might argue 3 to 4 hundred is a big number but the Patriot

systems still get better by the year. From the military point of

view: dealing with the Patriot systems is the same as dealing with

the large scale anti missile shield: a lot of cheap decoys

together with some real missiles will to the trick.

I think the Russian military engineers have some work to do in

order to make an efficient answer to this anti missile shield.

Good luck with it.

From the long term history point of view I

would like to add: I understand the feelings of the Polish people,

the borders of your nation have been messed up rather rough in the

previous century. I have nothing against a Polish membership of

NATO...

The picture below shows a short range Iskander

missile, you see 300 or 400 allowed is no big deal (to be precise

up to 400 much bigger missiles are allowed). I never heard of them

before but they clearly do not have nuke capability...

Item 5) The empty item.

Emptiness, only emptiness found here!

In case it is not empty enough, you can read

the most dumb 'financial expert' they have at Yahoo finance:

How to Ruin Your Morning

Till updates!

(06 Nov 2008) There is a need to unload some links because they

start polluting the tabs on my browser, so here we go:

Link 1) From an Australian academic who, just

like me, saw it coming. The author mentions Hyman Minsky and I was

glad to get to the ideas of Hyman; it saved me at least three full

months of thinking to understand what was going on.

Why Did I See it Coming and “They” Didn’t?

Link 2) From the black swan, without comment,

we have:

http://www.fooledbyrandomness.com/imbeciles.htm

Link 3) This is a link from today, but when

the Lehman credit default shit was to be materialized we only got

the DTCC stating that only 6 to 8 billion US$ changed hands. DTCC

stands for Depository Trust and Clearing Corp.

Of course this statement was a bag of shit

because Lehman only had far over 100 billion US$ sold in bonds

only. Other sources explained that LIBOR rates stayed so high for

so long after Lehman because of the 'unwinding' of Lehman, I

cannot confirm if that is true but if true the implication is

clear:

The unwinding is done via more borrowing.

Here is the link:

Credit Swap Disclosure Obscures True Financial Risk

And here is the old link that states the

Lehman unwinding is draining other borrowing capacities:

How Credit Default Swap Settlements Are Draining Liquidity From Interbank Market

Link 4) In case you missed it: Shame on you.

Quote of the fun:

Goldman Sachs is on course to pay its top City bankers multimillion-pound bonuses - despite asking the U.S. government for an emergency bail-out.

The struggling Wall Street bank has set aside £7billion for salaries and 2008 year-end bonuses, it emerged yesterday.

Each of the firm's 443 partners is on course to pocket an average Christmas bonus of more than £3million.

Comment: Please my dear folks, keep on

worshipping the rich & please work a bit harder to make them

more rich. That is why you are on earth: To make the bogus Goldman

Sachs rich...

Source:

"Goldman Sachs ready to hand out £7bn salary and bonus package... after its £6bn bail-out"

Link 5) On US election I really did not like

it observe all that idiotery around over there. Long waiting lines

like it was just another developing country...

So I picked up an old old math subject again,

I did not work on it for 16 years but it is strange, so utterly

strange how fast things fall back into good math.

Goal is (this time) to get more nice fractals

and I try to keep the level of the work at at most 2 years of

university so no fancy stuff like Cauchy integral representations

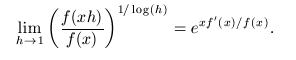

of linear operators (although that is tempting because it would

make me look as a smart guy while in fact I am a complete

idiot...).

Here is the

pdf thing, remark the last part is pure bogus math!

Till updates.

(05 Nov 2008) Flip flip flip, my endorsement US prez candidate

John McCain did not make it. That is a pity so my condolences go

to John McCain.

I will not make the mistake of offering

congratulations to Barack Obama, in my mind is a long history of

US military adventures since World War II and the USA still has

50% of the world defense budget. Sixteen months we were promised

by Barack, sixteen months to withdraw from Iraq... Lets wait and

see.

From a many century point of view it is not

bad to have a nigger in the White House, so I cannot give

congratulations but I can say 'not bad'.

To the future US government I can say: Do

your thing and as a small detail we have leaving Iraq within 16

months after the 20th of 2009. When you think you have 'enough

freedom' to do things I oppose you will find me on your way. And

as some nations might have found out: You will not like that.

To the Iraqis I can say: I expect you to

behave calm like a house father when the fucking US military is

leaving. For the time being I expect you to settle your inner

differences like you always did. Don't forget you have a big

wallet under your feet, the wallet has a name, it is oil.

Do your thing, I trust you to behave...

Title:

Sixteen months promised = sixteen

months delivered...

Just to give you an example how society

works: My son had a friend over and that 14 year old boy asked me

if I was in favor of Obama or McCain.

I told him I hoped for McCain because that

would better bring down US government bonds in the short run.

The boy did not understand it: "But our

entire school is in favor of Obama!"

After so much teenage wisdom I just skipped

stuff like "Murder rates are historically five fold compared

to normal democracies, their society is dependent on having 50% of

world defense budget, one in six Americans have no access to

healthcare and beside this the healthcare is just too

expensive."

I only asked the boy: If a coffin is two

meters long, how long is a row of one million coffins?

It took the boy some time but he coughed up:

2000 km (that is about 1400 miles).

And I informed the boy: Did Obama or your

school tell you that the Americans are responsible for this in

Iraq??? Of course the answer was a 'no'.

After that they were allowed to play video

games again, and I know it only takes one or two Hollywood movies

to repair the insights of the local teenagers: After a few

Hollywood movies all of the 2000 km of filled coffins are nicely

under the carpet...

__________________________

After all this preaching lets look at some

financial news:

Macro Man has some strange graphics upon

boring stuff like money growth in this:

How Will an Obama Administration Affect the Dollar?

And via that link we have from Bespoke Investments:

VIX Declines a Little

Comment: The VIX is also a 'panic indicator'

so shall I pump it up with better bombshells? No this is not wise;

The investment community has to understand that my goal of 7000 on

the DOW Jones index mostly will go via the 'price to earnings'

ratio.

Only the P/E ratio on a longer term will

bring wisdom to those still seeking profits from the 50% of world

military budget.

As Jesus once said: Those who live by the

sword will get killed by the sword.

But Jesus, if only he knew about financial

attacks to kill the sword...

Till updates.

(04 Nov 2008, second update) I am watching the US elections on

CNN with utter amazement: The rows of people before they can make

their vote are just so long... Can anybody explain to me the

difference between a third world country and the USA?

I am now 45 years of age and voted in almost

all elections since I was 18, the longest waiting line I can

remember was six to seven people and

I was annoyed at myself because I was so stupid to vote during

lunch time... And I was annoyed because I had to wait a few

minutes...

Compare this to the US of A: Many hours of

waiting, voting is obliged otherwise you get a fine & most

of all you can only choose between idiot number one and

idiot number two.

Can anybody explain to me what this has to do

with democracy?

Here in Holland voting is voluntary (the

obligation was skipped somewhere after World War II or just before

that). I can vote among a wide range of political parties, on the

contrary the Americans are obliged to vote and can only choose

between idiot number one and idiot number two...

Can anybody explain to me what this has to do

with democracy?

Can anybody explain to me the difference between a third world

country and the USA?

Till updates.

(04 Nov 2008) Today the most expensive version of American

idols is on the television all day long; costs only 1.5 billion US

and that is about 500 million US$ more expensive as the elections

in 2004.

I really did not feel like looking a two guys

making idle promises all day long; the Republican candidate McCain

thinks he doesn't need to raise taxes (well how to pay for the 850

billion US$ non working bailout program?) and the Democratic

candidate thinks investing in stuff like infrastructure will do

the trick.

Ok ok, any candidate that would simply tell the truth would never

get elected; the American citizens have a strong tendency to want

to live in some fairy tale version of economical realities...

So after waiting 16 years I picked up an old

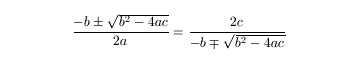

math subject about generalized multiplication in n-dimensional

real spaces. Given the fact I picked this up after 16 years, it

was amazing how easy it was to reconstruct the theory. I think it

has never left my mind for real because large problems from 16

years ago melted away like the savings of the Americans.

I have a good introduction and already have a

funny end with the best scientific bogus I have ever written. Not

that the theory is bogus, no I consider it my best work. It is my

best work because it borrows from almost all major fields in math,

but the zero one project learns us that you must be able be have

some 'relativity attitude' in order

to get to your goals in a good health. As a comparison, the pi-radius

work is only ranked at number three or below that.

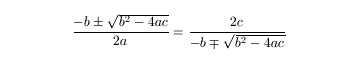

If you click on the picture you get the best

of my scientific bogus & before I forget it; I want to thank

the Americans for making the LaTex package a free package for the

international math society.

No, I am not sarcastic, the LaTex package

often gives a lot of headaches but it's for free and may be the

Americans should do that with some more stuff from the

'intellectual resources'. Here is the bogus:

Till updates, have a nice bogus life (read:

be a banker) or try to get one...

(03 Nov 2008) This day only a bit of math, on Barry's hangout

there were five vids about fractals. Here

is barry's source file. But when you try to play the video it

says: You are not inside the US of A and so you cannot view the

video.

This is a strange pattern observed; as far as memory serves it

was the White House that did stuff like that for the first time

(that is according to my memory) in the 2004 elections. Another

example from this election is the IQ test that advocates John

McCain has an IQ of 138, but when you click the advertisement it

is again 'You are not inside the US of A so you cannot view this

file'.

On the one hand you can argue this is only a

manifestation of isolism that naturally comes with crises like

this, on the other hand you can ask 'What the fuck is happening

over there?'

Luckily the third comment of Barry's file

says the next, quote:

If you are outside the US you can still view the fractals using VLC media player. Using the link below:

mms://pbs.wmod.llnwd.net/a1863/e1/general/windows/wgbh/nova/

fractals-3514-c01-350.wmv?v1st=8A9DD94AB38FD74&vsdomain=pbs

Change the part “c01″ to “c02″ and so on to view the next series

Comment: On my computer system here in Europe

you do not need the VLC media player, I used the Microsoft

standard media player.

Here is some fractal picture and click on the

number to get the video number:

I hope it works and you do not need weird

players (although it is thoroughly advised never ever to use the

Microsoft player as your default player!).

But this update was supposed to be about math

and not upon isolism or your default player:

When I was a student I generalized the so

called 'complex multiplication' as far as possible into all

dimensions. It was a (relatively) great work; lots of isolated

math studies like 'calculus' or 'system theory' were combined into

a wonderful theory.

Anyway, I thought it was wonderful but the professors did not

agree for a large part.

They were, just like me in the first three

months of my study, only inside the fishbowl of the complex

plane...

Lets leave it with that.

Have a nice US election day tomorrow or try

to get one.

(02 Nov 2008) Only one item and one link today.

Item 1) Prudent Bear guest commentary; the

good stuff.

Link 1) More on chained dollars.

Item 1) Prudent Bear guest

commentary; the good stuff.

I only did a little or financial news reading

this weekend (because most things run the expected course) but on

the Prudent Bear website the most significant news was found.

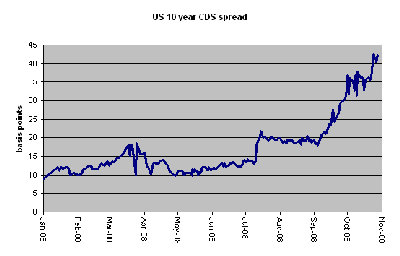

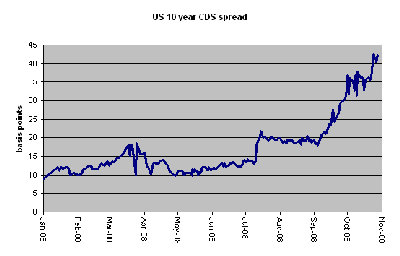

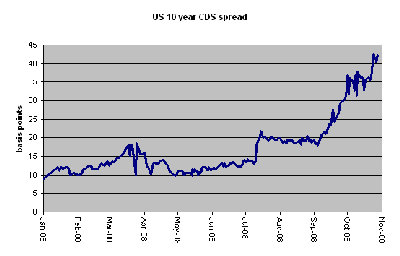

It was around the US 10 year CDS spread, for

normal folks this means:

How expensive is it to insure the value of your US government

bonds?

It is now 40 pips or 0.40% a year, the contracts are usually five

years long so it costs now 2% of your investment in US government

bonds to insure this against USA default for a period of five

years...

Still bargain prices if you would ask

me.

Click on the next picture to get the graph a

bit sharper:

Lets do the math: 40 pips is 0.4% and as a

number this is 0.004. Therefore the sellers of this insurance

think that the USA only defaults every 250 years (this given the

present turmoil). I only repeat: European pension funds should buy

this while it is at such bargain prices.

Think for yourself: once in 250 years?????

For the rest, only a quote from the file (source):

This has perplexed, and even amused, some market observers. How, they ask, could a private sector contract against default be expected to pay out in the case of a US government default – which would be the equivalent of a nuclear explosion in the financial markets? So what’s the point of buying such a contract?

Comment: For inside the USA it does not make

much sense to buy stuff like this, for long term European pension

funds it makes a lot of sense. Lets leave it with

that.

Link 1) More on chained

dollars.

In the chained dollars department there was a

good link found (USA statistics of course):

Real Per Capita Disposable Income Biggest Drop Since 1949

The link contains good info (another link),

scroll down to line 37:

Scroll

down to line 37

Till updates.

(01 Nov 2008) As usual five items:

Item 1) New food: Mark 77 Fire Sauce.

Item 2) Hedge fund and pension fund hammering.

Item 3) More on the USA gross domestic product.

Item 4) Jesse still thinks the system can be saved with more debt.

Item 5) The empty item.

Item 1) New food: Mark 77

Fire Sauce.

My dear Afghanis and most of all my dear

Iraqis, I know I have been lax on my duties towards you. I am

sorry for this, but the breaking down of funding for the US

military goes so good that I mostly concentrate on that...

Here is only a third food thing named Mark

77 Fire Sauce, the fish soup and the other food items still

have to be published & lets not rush and declare victory when

in fact the US military is still alive...

Most of all, the final calculations around

the zero one project still have to be published. And since I hope

that by now my fellow scientists know that I can craft good statistical

tests, the zero one project will be taken a little bit more

seriously...

Item 2) Hedge fund and

pension fund hammering.

From Pension Pulse we have two good links,

one about hedge fund hammering and one about pension

hammering:

http://pensionpulse.blogspot.com/2008/10/closing-gates-of-hedge-hell.html

http://pensionpulse.blogspot.com/2008/10/kaboom-pension-bombs-exploding.html

No comment, have fun reading it.

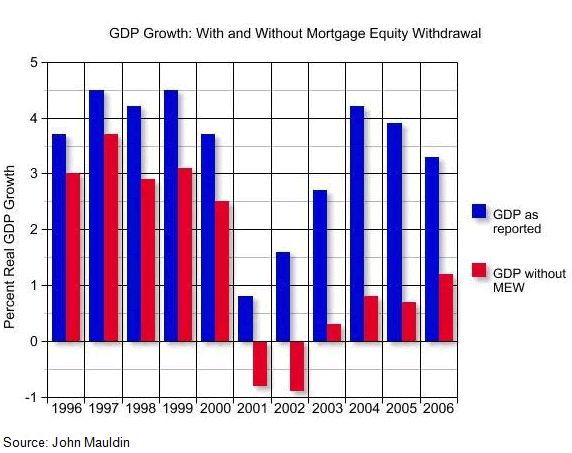

Item 3) More on the USA

gross domestic product.

Two days ago I did some exotic attack on the

US real domestic product and shaved about one trillion off that

number. In case such stuff is too exotic for you, there is also

more down to earth stuff.

Econ Browser analyzed the diverse components

of the latest USA gross domestic product report & it looks

that without US government spending things would be far more

worse... Welcome to the United Socialists of America:

http://www.econbrowser.com/archives/2008/10/some_additional_1.html

And from some Time web log we have:

The

GDP report: Moderately bad, perhaps more than moderately misleading.

Again no comment, use your own

brain!

Item 4) Jesse still thinks

the system can be saved with more debt.

A lot of otherwise smart people think that

when you borrow yourself into trouble, you can also borrow your

way out of these troubles.

Yet the law of gravity forbids anti gravity,

that is an elementary fact of live.

Beside Jesse also Barry still thinks the

present system can survive & so I ponder if there is a flaw in

my own thinking. I cannot find the flaw, I think that when you

borrow yourself into troubles you can not borrow your way out but

you have to work your way out...

After so many years of overspending, there

will be years of underspending. If there still is some borrowing

capacity left this only means the years of overspending are not

entirely over. It' s all pretty simple...

Here is what Jesse thinks:

Avoiding a Great Depression: Rescue, Rebalance, Reform.

Again, no comment.

Item 5) The empty

item.

Today on CNN I viewed a report from a

graveyard in Iraq. The CNN reporter told stuff like 'until now we

could not visit a site like this because the security situation

did not allow for this'.

This was a strange remark because so many

years so many reports were there from 'embedded reporters'

from 'dangerous places'.

The report of this day only validates we

could easily look at a so called 'excess death toll' inside Iraq

of over one million. The US military has full responsibility for

that because we all know the present US government is just a bunch

of idiots.

The US military started to use Iraqis to kill

Iraqis and the wisdom of that can be measured on the graveyards of

Iraq.

The US military cannot hide behind her

political leaders, the US military were the

boots on the ground that did this. And they did nothing,

just absolutely nothing to report to

the White House what the consequences of followed policies were...

Lets hope this item is empty enough...

Till updates.

(31 Oct 2008) With all this emotion in the air with all these

declining stock market stuff, every body starts cherry picking

data to proof his or her fabulous insight.

Let me do the same, it is just two hours

after US market closure and here is my source

file and here is my cherry picking:

-- The Dow fell for eight straight sessions -- the longest losing streak since the eight days of declines following the Sept. 11, 2001, terror attacks, when the blue chips lost 1,038.12, or 10.8 percent. It lost a staggering 2,400 points, or 22.1 percent.

-- The market's volatility was so intense that there were just three days during the month that the Dow didn't rise or fall in triple digits. The Dow set new records for one-day point gains, 936.42 and 889.35, and for one-day point losses, 777.68 and 733.08.

Comment: Not bad, for the rest no

comment.

Till updates.

(30 Oct 2008, item 3 is updated and corrected on 31 Oct) Today's five items:

Item 1) New wallpaper made (1024 by 768

pixels).

Item 2) The Macro Man has absolute fantastic graphics.

Item 3) USA chained dollars gross domestic product: 11,720.0

million.

Item 4) The USA GDP deflator and conspiracy huggers.

Item 5) The empty item.

Item 1) New wallpaper made

(1024 by 768 pixels).

For many years I use wall papers from the

Hubble space telescope, today I modified one of them. Here is the

original:

And this is the modification:

At http://hubblesite.org/gallery/wallpaper/

there are a lot more.

From the moral point of view you can use them because using them

has no positive contribution to the nominal or real US gross

domestic product...;)

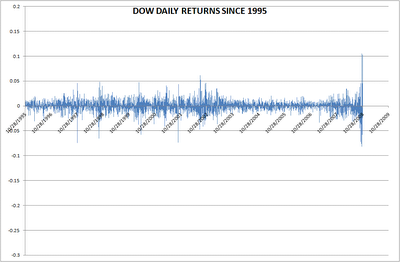

Item 2) The Macro Man has absolute

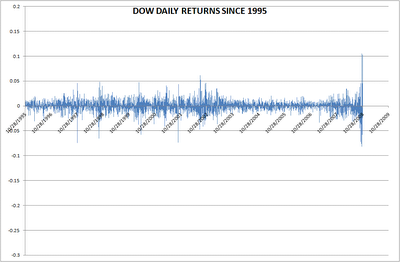

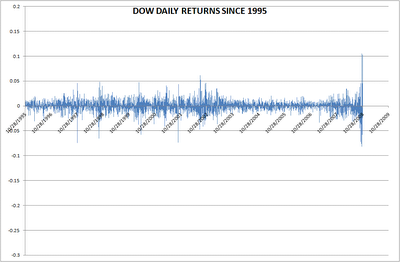

fantastic graphics.

On Seeking Alpha the Marco Man has absolutely

fantastic graphics, in the picture below you see all daily returns

from the DOW Jones (SA source).

I hope you understand a 'return' of 0.1

refers to a 10% increase... You observe: Since 1995 the negative

spikes are often larger than the positive spikes, if this goes for

now the biggest declines still have to come!

Item 3) USA chained dollars

gross domestic product: 11,720.0 million.

Today I wanted to start an investigation if

indeed the USA deflator figures are understated yes or no. That is

because a few days ago I wrote that the US gross domestic product

could be overstated by as much as 10% & beside idle I have a

habit of backing up my words.

Although I could find some data needed in

this table

oversight from the US Department of Commerce, Bureau of

Economical Analysis, at first glimpse I could not find all the

information I need.

But I found another 'cut the corner' table

that gives a clue that indeed this structural overstatement of the

US gross domestic product is there.

When you look at so called chained dollars

you can craft the next table of the US gross domestic product in

chained dollars:

| US GDP in

chained dollars (source) |

| Year and Quarter |

GDP in millions of chained

dollars |

| 2000 Q1 |

9,695.6 |

| 2008 Q3 |

11,720.0 |

To be honest, I never heard of chained

dollars, here

is a definition that explains the word 'chain' but technical

details lack.

11720 / 9695.6 = 1.2088 hence 20.88% GDP

growth in 8.5 years.

Thus a yearly 'chained' GDP growth of

1.2088^(1/8.5) = 2.26%.

That is not very much, but the US Department

of Commerce introduced it herself to let 'changes in the purchasing power of the dollar'

out.

Good stuff isn't it? Because 2.26% is beyond

the long term GDP growth since we left the golden standard and

started hugging fiat money...

Begin: Update

& correction from 31 Oct 2008.

Yesterday I made a gigantic mistake, I was

thinking that 'US dollar purchase power' contributed to stuff like

the US dollar index and this was utterly wrong.

It seems that this dollar chain thing is only

an inflation thing, it has nothing to do with global purchasing

power of the US$ but only a local (inside the USA) thing. The

'chaining technique' is not relevant, just like their are many

ways to construct a price index there are many ways to calculate

the present GDP in 'year 2000 dollars'.

So the present USA GDP of over 14 trillion

US$ is only 11.72 trillion in 'chained dollars' And when using

this real USA GDP growth over the last 8.5 years was only 2.26% a

year...

The problem remains the same: Can I shoot a 5

to 10% hole in the 11.72 trillion?

Of course I can, as a matter of fact it is a

cakewalk.

<Begin:

Cakewalk.

As the Americans are experiencing; the costs

of living in your house can be a large part of your budget. And if

these costs climb wouldn't it be nice if that would be reflected

in the consumer price indices?

As a matter of fact the costs of living in

your house is nicely kept out of the inflation numbers; all those

years house prices went through the roof so called 'consumer

inflation' was artificially low. This was handy for the US

government so they could keep the rates on debt too low for too

long.

The US government uses so called 'rental

equivalence' to measure the cost of living in a house, they do

this because using rental equivalence differentiates between the

'true costs' and your 'investment component' on paying the

mortgage.

There is only a little problem: On average

you folks only live about seven years in a new home and given the

present decades of mortgage payments your 'investment component'

is rather neglectable. (Only in the last seven years of your

mortgage payments you make significant 'investment components').

To make a long story short:

You were fooled all those years when house prices climbed too fast

and credit was too cheap. Housing is a large part of consumer

payments and all those years the deflator was too low.

Hence from the reported so called 'real US

gross domestic product' we can easily withdraw another trillion to

arrive at something like 10+ trillion in so called 'year 2000

dollars'.

End:

Cakewalk>

End: Update

& correction from 31 Oct 2008.

Item 4) The USA GDP

deflator and conspiracy huggers.

One of the strange characteristics of the US

society is that when you doubt some generally accepted things, you

are suddenly a 'conspiracy seeker'. Instead of going into a debate

and look at arguments pro and contra, you are suddenly a

'conspiracy seeker'.

There are some roots to this, remember the

Iran contra scandal under Ronald Reagan? Folks who tried to expose

reality were of course only 'conspiracy seekers'.

But let not loose ourselves in old history;

Barry was complaining that rising oil prices (from imported oil)

brought down the deflator and thus the GDP was propped up by this.

Barry had a good point in this because the Americans do not hug

the real GDP but it's (price) inflated version.

Here is some of the conspiracy feeders critique

(source)

Over at the Big Picture, Barry Ritholtz has been constantly complaining that the GDP deflator is underestimating inflation. Well I’m not particularly surprised since the GDP deflator does not measure inflation persee.

His specific concern is that the rising oil prices have decreased the GDP deflator - he thinks this is ridiculous, however, if we are willing to stop being conspiracy theorists for a little while we will see that it is fine.

GDP=Consumption + Investment + Government Spending + Exports -

Imports

As a result, if the volume of everything was unchanged (such that real GDP was unchanged) but import prices rose, nominal GDP would fall. As a result, rising import prices lower the GDP deflator (as this is what is used to adjust the nominal figure to a real figure). Since oil is imported, and since the imported price went up a lot over the June quarter, this drove the GDP deflator down.

Real GDP is a measurement of the volume of production in the economy, which is why this makes sense.

Comment: It also makes sense that when prices

go up, sold volumes go down. Imported or locally produced does not

make much of a difference I guess. So the example given (leaving

all other changes out beside oil prices) is rather dumb: it works

only with small changes if and only if these small changes can be

borrowed...

One way or the other the extra money needed for oil cannot be

spend on other items.

Matter of fact is there is a whole range of problems with the

official US statistics and they have nothing to do with conspiracy

but with people not understanding their core business.

Just like insurance company AIG did not understand her own core

business (insuring risk)...

Item 5) The empty

item.

Empty empty empty & more of that vacuum

cleaner stuff; think for yourself!

Till updates.

(29 Oct 2008) Just a lazy update today, a few links and a short

reflection on the Federal Reserve rate decision from today.

Four days ago I posted an update around a guy

named Nassim (Nassim and me have strong correlation in the way to

view financial risks) and my colleague in math Benoit Mandelbrot.

There seems to be a video of the conversation I quoted from, I

hope this link works:

http://www.pbs.org/newshour/video/module.html?mod=0&pkg=21102008&seg=5

And if that does not work you can try:

http://bigpicture.typepad.com/comments/2008/10/pbs-video-taleb.html

Most other financial weblogs of importance

already linked to it, but for reasons of being complete let me

quote some fun (Bloomberg source):

``This year's financing needs will be unprecedented,'' said Anthony Ryan, the Treasury's acting undersecretary for domestic finance, at a Securities Industry and Financial Markets Association conference in New York, where he was a last-minute substitute for Treasury Secretary Henry Paulson.

Comment: Indeed from a macro economical point

of view this is very interesting because even without 700 billion

bailout programs it was already doubted that the USA could pay

back her debt, let it be local or foreign debt.

__________________________

Now a short reflection about the US Federal

Reserve rate decision (50 basis points down to 1% & this is

viewed as 'aggressive).

Begin intellectual

reflection.

A few months ago the worlds Central Bankers

gathered in Basel and one of the more important statements was

that 'from now on even in economical prosperous times interest

rates should be higher to avoid another round of this present

chaos'.

There he was sitting: The idiot Bernanke, no

sweat always mister cool. He 'agreed' to that insight too.

And so the first thing the FED does is

lowering and lowering, this is a first solid clue the USA will not

oblige her future payments on US government bonds.

That is only lesson number one we can draw from this rate

cut.

Lesson number two is a future lesson:

When given the choice between funding the US

military and paying her international debt off, the USA will

always choose for funding the US military.

If you don't believe me, why don't you start

a study of murder rates in the USA? Historically they are five

fold compared to normal democracies, if you do a bit of deep

thinking and connect the dots there will be only one conclusion

left:

Country first & military

first...

And dumb Central Banks like those in China or

Japan will take heavy losses and say 'This was not foreseen by all

experts'.

End intellectual

reflection.

Title:

The Americans are so easy to

understand:

Dumb, fat & obese, hautain & arrogant.

At last don't forget there are a whole lot of

dumb Central Banks around that give away their reserves in

exchange for US dollars, here is a Yahoo link:

Fed announces new credit lines with foreign banks

Till updates.

(28 Oct 2008, second update) Now in effect former Federal

chairman Alan Greenspan is trashed, it is time to move on and

trash the battalions of debt hugging USA economists. Let me first

give you some workable definition of a trashable debt hugging

economist:

This is a person who sees no problem when

debt levels blow up exponentially at a higher rate than the gross

domestic product.

In general these are folks who borrow a lot

of their thinking from economic theories from the old days of the

golden standard where the total global gold reserves served as a

natural ceiling for too high debt levels.

The USA economist I have to trash today is James Galbraith

(found via Barry's hangout; source).

I could write a complete book about why this guy is wrong in

almost every detail so I only highlight one:

Somewhere in the video James Galbraith states

that in the USA they have social security and that for about 40%

of the elderly this is their only source of income.

Debt hugger James Galbraith forgets to

mention that these social security funds only contain Treasuries,

the money collected in the past is long long gone on weird stuff

like wars or outbailing banks. Debt hugger James Galbraith thinks

that the rest of the world is a piggy bank for the USA, but James

why should we borrow you folks more money

when you have already the most 'vibrant economy' around?

Seldom you see so many economical nonsense as

in the next video:

http://www.pbs.org/moyers/journal/10242008/watch2.html

Till

updates.

(28 Oct 2008) Items here, item there, items that are

everywhere:

Item 1) Case Shiller fun fun fun!

Item 2) Porsche & VW do some good hedge fund ramming.

Item 3) The Upas tree kills everything in a 15 mile radius.

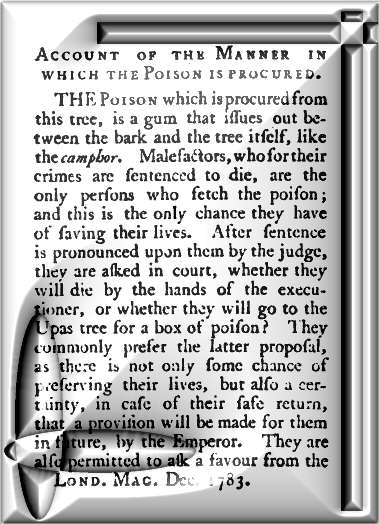

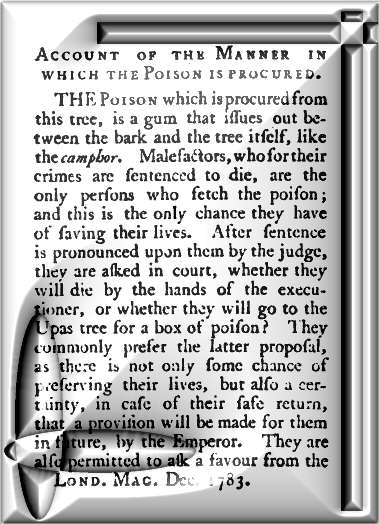

Item 4) For the first time in history: S&P down in a 10 year

period.

Item 5) The empty item.

Item 1) Case Shiller fun

fun fun!

This day we had the latest Case Shiller