|

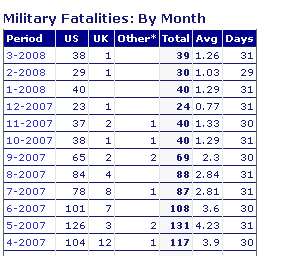

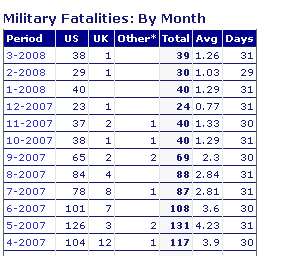

(25 June 2008) It is tempting to comment on the

relative spike there is in US military deaths in Iraq and

Afghanistan, but I won't.

It is tempting to make a fool of the ECB prez

Jean Claude Trichet who truly thinks that inflation is anchored

here in Europe, but I won't.

No, today we look at the ease banks still

collect fresh capital. Who are those sucker investors who bring

their money to the big ovens? Don't you think it isn't amazing?

Invest now in banks?????

Via the Winter blog I found a nice article (source),

quote:

As of last Friday, North American banks had raised $158 billion in capital since the third quarter of 2007, almost matching the $175 billion in losses they reported during that period, according to J.P. Morgan Chase.

Comment: Isn't this amazing? 158 US$ in fresh

capital and who are those sucker investors? These so called

'investors' don't have a clue how banks work with their off

balance items (that don't count in the reserves), their Level 3

assets who are not measurable, their this and their that.

Lets just look at one more of the amazing

details in the article, quote:

For instance, at the same time Wachovia announced a net loss of $350 million in mid-April, it said it had sold $3.5 billion worth of common stock and $3.5 billion of preferred. Mr. Welshimer noted that some banks, such as Wachovia, have tried to pre-market offerings to make sure they get sufficient interest from investors and also to be able to mitigate bad news about losses with the announcement about fresh capital.

Comment: The sucker investors simply do not

understand that when Wachovia raises 7 billion while posting only

350 million losses, future losses will simply amount to 7 billion

or more.

Luckily there is

no problem for me; With the policies of Alan Greenspan an awful

lot of non productive capital was pumped into the US banking

system and economy. All this excess capitol has to be burned away

before that economy can function properly again. Banks selling

stocks or whatever what is a good way to burn money.

Anyway it is better compared to investment in food and commodities

because those investors are the real sucker investors from the

Rape Pillage and Plunder Investments...

Lets leave it with that, till updates.

(24 June 2008, temporary update) Long awaited:

Two important statistics!

Statistic one: About US corporate earnings,

mostly the S&P index (source)

quote:

Second quarter profits are expected to fall at a rate of 10.2 percent, compared with the Monday estimate for a drop of 9.6 percent. At the end of May, analysts expected a 7.3 percent drop.

A worsening outlook for consumer discretionary and financials was behind the bleaker earnings view.

Comment: Long have I been waiting for stuff

like that, also these are only expectations... If true, the US

stock markets needs to decline at least 10% in this quarter.

Statistic two: Case Shiller housing index (source)

quote:

The S&P/Case Shiller composite index of 20 metro areas fell 1.4 percent in April from March and slumped by a record 15.3 percent over the year.

Economists expected prices for the 20-city index to fall 2.0 percent in the month and 15.9 percent from April 2007, according to the median forecast in a Reuters survey.

S&P said its composite index of 10 metro areas slid 1.6 percent in April for a record 16.3 percent annual drop.

Comment: 15.3% decline year on year means

over 3 trillion of US family housing lost equity this year... For

me it is still funny to observe that there is absolutely no talk

whatsoever on numbers like this in the mainstream media. Ha! How

come that those millionaires from CNBC never talk about that?

And why not do some easy to understand

calculation?

From March to April house prices declined

1.4% in the 20 metro areas.

That is 1.014^12 = 1.18 thus 18% year on

year.

Hence: luck is on my side because the monthly

decline is still above real year on year decline; we have not

reached the turning point yet. We must be cautious because I did

not build the calculations on a raw data set but it was retreived

from the media sources mentioned above. But it is reasonable to

suspect the turning point still ain't there.

Till updates.

(19 June 2008) Today I found a sad update from

oil actions from the Iraqi puppet regime. Although it is now 2008

they still abide by the classic definition of a puppet regime.

What has this puppet regime done when it comes to building

hospitals in Iraq? Practically nothing, and on a whole lot more

they constantly prove they are just another puppet regime.

Let me name four oil companies, here they

are:

Exxon Mobil, Shell, Total and BP.

According to this iht

file they have reaped the new oil contracts. I am mad beyond

hell with my anger. The Kurdish were allowed to place the new

contracts and even when names like 'Hunt oil' from Dallas entered

the scene, I kept my mouth shut.

This time I will not keep my mouth shut: We

cannot have the pre Saddam oil companies take over like nothing

has happened like for example the one million deaths from the

economical sanctions against Iraq. And so after I invited the

Afghanis I again remember you folks of the impending Military

Bloody Day that is located at 26 July this year...

And so, if the Iraqis have any pride left, do

they allow the old oil companies to provide more profits to fatbag

Americans? And give rise to the old oil powers again? I don't

think so and I call on the Iraqis to make the US military pay for

their Rape Pillage and Plunder investments they are making.

Let me quote from the iht file:

"There is an enormous amount of oil in Iraq," Raymond said. "We were part of the consortium, the four companies that were there when Saddam Hussein threw us out, and we basically had the whole country."

Comment: And big oil still wants that country

back, for example because lately they have some demand problems.

Would the Iraqis like to be some real population or do we have

future stuff like 'we basically had the

whole country'

Better kill the slime before the slime kills

you!

Till updates.

(18 June 2008) In this update I want to look at

three items:

Item one) Wise words from hedge fund manager

Paulson, he thinks there will be about 1.3 trillion in down

writings related to the US housing market.

Item two) Some analyst(s) from the Royal Bank

of Scotland foresee a stock market crash of about 25% somewhere in

the next three months.

Item three) We ponder if financials will

again decline another 50% from the present values.

So lets begin with

Item one) Let me quote (source):

June 18 (Bloomberg) -- John Paulson, founder of the hedge fund company Paulson & Co., said global writedowns and losses from the credit crisis may reach $1.3 trillion, exceeding the International Monetary Fund's $945 billion estimate.

Comment: Since this Paulson has made giant

profits from the US housing decline his words carry more weight

than the words of a lot of other folks. From the IMF we know

already they are dumb beyond the Piccadilly circus and my

estimation is: two trillion or more. Let me explain in a nutshell:

When you study US median house prices and US

median income for the period 1996 to 2006 you arrive at the

conclusion that from the top the median house price will decline

about 50%.

And 50% of total US family housing equity is something like 10 to

12 trillion US$.

If from that decline in family house equity only one fifth makes

it to the books of the financial institutions you have two

trillion in direct down writings related to the jokes Alan

Greenspan performed.

So far for item one, we proceed with

Item two) Let me quote (source):

The Royal Bank of Scotland has advised clients to brace for a full-fledged crash in global stock and credit markets over the next three months as inflation paralyses the major central banks.

Comment: In the months before the collapse of

Bear Stearns Cos I too thought that the crash scenario was the

most likely, but at present the US Federal Reserve has five

programs of 'providing liquidity' so instant crashes are avoided

that way. Therefore the scenario known as 'death by a thousand

cuts' is still the prevailing scenario.

Although inflation is rapidly rising (and the Central Banks did

not foresee that!) I still view this as another squeeze on the

profits of companies, but I have to admit that this squeeze is

even broader compared to the credit crunch.

My estimation is that stocks will decline a lot more but that

there are no reasons to expect a sudden tsunami in stock decline.

Look for example at how easy the banks collected more and more

money to 'strengthen their balance sheets'; this only proofs that

there is still a large pool of sucker investors out there who have

too much money and too little brains because any idiot could see

you must not invest in banks...

This brings us to the latest item:

Item three) In the picture below you can see

what giving up the golden standard did for the US financials. In

this world of fiat money they almost made it to 25% of total

market cap and that is a bit strange don't you think?

Don't get me wrong, I am not advertising for going back to the

golden standard, but in my humble opinion a commercial bank is

just like a water company; important because you can't live

without them but regulate them otherwise they will choke you...

My dear reader, make up your own mind: Having

financials being such a large part of total market cap, is that

healthy for the economy in the long run?

(The picture is from Societe Generale and I

found it via Barry)

Till updates.

(13 June 2008, updated 15 June) Today I feel like preaching to

the ECB but first we have this:

Exactly five months ago (see this Financial

2 update from 13 Jan) I gave some prize to Chinese and

Kuwaitis for the most stupid mega deal for the year 2008. (They

were that dumb to invest about 5 billion in one of those weird

American banks.)

And although we have observed hundreds and hundreds of so called

'experts' stating the credit crisis was almost over, my analysis

of the situation is still standing and I am sorry to say but this

whole crisis is not over by far.

__________________________

Before we proceed with preaching to the

European Central Bank I would like to explain the difference

between 'embedded' and 'anchored' inflation.

Anchored inflation is a situation where there

is indeed inflation but workers cannot demand higher wages so a

lethal 'price wage spiral' can be avoided.

Embedded inflation is a situation where the

working population expects continuing inflation and thus will do

their very best to get enough wage increases to compensate for the

inflation.

So far the theory, lets now look at just some

facts from the last time:

Fact 1) ECB President Jean Claude Trichet

thinks that European inflation is anchored, anyway he said so.

Fact 2) Today the last labor unions here in Holland made the deals

with the employer unions; result 3.3% more wage while the labor

unions started the negotiations with 3.5%.

Fact 3) Here in Holland consumer inflation stands at something

like 2.4% at the moment.

Fact 4) The labor unions reported that a record of strikes was

needed in order to get the desired results. (That is true, strikes

hit a multi year record.)

Conclusion: Here in Holland inflation is not

anchored but embedded.

Fact 5) In Spain shops are running empty only

because of protests against high fuel prices.

Conclusion: Likely the Spanish workers do not

like a Trichet anchor around their neck either.

Fact 6) For the most years the ECB has not

met her own 2% threshold on inflation and not met her money supply

threshold of 4.5%. Both were higher almost all of the time.

Conclusion: The European Central Bank, more

often than not, does not stick to her own mandate. If the ECB did

not stick to her mandate in those easy years, why should they do

it now? With every policy setting meeting they loose more and more

credibility.

Fact 7) The Central Banks and the commercial

banks have created the present credit crisis, the Americans are

(as usual) most to blame but the Europeans kept silent during the

Greenspan years.

Conclusion: And now this Trichet mental dwarf

comes telling us we should keep wage demands low... Why not let

the banks pay for the mess they have created?

They did this although some governments are also to blame. The

Spanish and UK governments simply deserve their decline of real

estate, or not?

All in all: countries that sided the most with the USA not only

have the most problems but also create the most. The nations

pushing for lower and lower rates and more and more debt are the

ones who kill countless millions in the development nations

because our pension funds hang out the day trader on the food and

commodity markets.

Don't forget that in the not so long ago past most food and metal

markets were globally just an average Nasdaq listing size

market...

Of course most Central bankers do not know that, but what do

Central bankers know anyway?

Title:

Trichet the anchor of the Euro? I

don't think so...

We end this update with a funny note: I have

found a niche of the US housing market that is still booming, the

folks in those houses have 'gift wrapping rooms' and 'florist

rooms'. Here

is the fun.

That housing market is tale telling for eight years of Dubya; the

best US prez ever!

Update from 15 June:

On seekingalpha dot com was a nice article

about Central Banks fighting inflation, the title of the article

was:

Will the World's Central Banks Successfully Fight Inflation?

The answer is of course a big NO because right now the ECB is

already 3 to 5 months too late and given the time delay at witch

rate increases work the stagflation scenario is still the most

likely at this point in time.

If you scroll down that article you can read my comment on it at

entry number 4.

On Bloomberg dot com you can find a nice

article about wage increases in Europe, let me quote a bit of fun

from there (source):

"One element of the ECB's analysis has changed quite substantially from before: the assessment of wage

developments."

Comment: If the ECB did not get it in the

last six months, they will not get it in the next six months. So

although rate hikes are desperately needed, they will rather

likely not do it for reasons still not understood by me.

__________________________

This update was started with the most

stupid financial mega deal for the year 2008.

Today I found the most

stupid more pumping oil up deal done by Saudi Arabia. From

next month on rumors say the Saudis will pump up about 500

thousand extra barrels a day. Why is this the most stupid oil

deal?

There are dozens of reasons, let me name only

a few that carve some wood:

Reason 1) Daily shortage is about 1.5 to 1.6

million barrels a day, with the extra output it will be 1.0 to 1.1

a day. So the pension and hedge funds will keep on playing their

oil tricks on the oil futures markets.

Reason 2) Lately the Paulson clown (that is

the US Secretary of the Treasury) stated more than once that

speculation on oil markets was simply not true. It was only very

insignificant because 'futures follow the real markets'.

And with so much moral backwind the pension and hedge funds will

keep on buying more and more oil futures and roll them over month

in month out.

For me it is utterly weird to observe that

the Saudi oil sellers do not understand the nature of the oil

pricing mechanism; have they forgotten all those years when oil

was between 20 and 30 US$ a barrel? And they always nicely pumped

up more because the Americans said the global economy would suffer

if oil went too high?

The Saudis were slime in those years because the US economy

profited the most from the below 30 US$ level and now we are in

the endgame the USA speculators profit the most from the rise. So

again the Saudis are only slime.

Some folks call it a Mad Max economy but I

prefer Rape Pillage and Plunder Investments; if the Saudis are to

stupid to see what is actually happening it is not my problem. If

the Saudis willfully let this slaughter continue in the developing

nations, let Allah judge these slime heads

and not me...

Till updates.

(10 June 2008) Lately we have all kinds of

central bankers coming along, first we had the 'pretending to be

hawkish' Jean Claude Trichet telling folks that in the next

meeting we could see yes or no a rate hike. So that was idiot

number one because today we also had the yoy wholesale inflation

from Germany running at above 8%.

On the comments of idiot number one we

observed idiot number two named Bernanke from the US FED.

Idiot number two informed us that the

'downside risks' to the US economy were parked on Pluto and thus

it is time to look at the dollar value because there is a tiny

tiny relation with inflation.

After idiot one the Euro shot up to 1.58 US$.

After idiot two the Euro shot down to 1.55 US$.

The ECB should be ashamed of herself; they

turn their mandate into second hand toilet paper while in the mean

time pension funds make a stupid run on food and commodity

markets. And why not ask the Italians to leave the Euro, pick up

their beloved lire again and see what it does for Italian

inflation?

In the meantime you sure must view the next

CNBC video where five Americans do not shout hard enough and enemy

combatant Dubya also throws a coin in, link:

http://www.cnbc.com/id/15840232?video=765631137

After all that long term wisdom from that

video you can visit the Winter blog where I found that link:

http://wallstreetexaminer.com/blogs/winter/?p=1709

And if you are still hungry about more of

that complicated financial stuff, why not hang out at Barry's

place? Link:

http://bigpicture.typepad.com/

If after that you are still hungry, you are

some big beast and my advice to you is: Try to kill some

Americans, it does not have to be that coffin stuff but if you can

bring great fire power against those idiots you are my friend...;)

Till updates.

(08 June 2008) The main dish of this days update

is a message to the OPEC but we start with two times big big fun.

---Funny detail one: Finally the two bond

insurers where you could buy an AAA rating in case you didn't have

one are downgraded from their AAA status. About one trillion is

downgraded two notches and we are not talking about bank

investment vehicles. No no, down to earth municipal bonds and

stuff like that.

Wow, one trillion downgraded... That is expensive...;) Link:

http://www.bloomberg.com/apps/news?pid=20601087&sid=apwRNJVHwpBQ

&refer=home

---Funny detail two: For years and years I am

arguing that the information streams at the Pentagon are highly

dysfunctional. What did the Pentagon boyz & girlz do?

On 95 new weapon programs they are 300 billion over budget!

Ok it isn't victory but 300 billion is still 60% of one year non

war funding (war funding goes via borrowed and earmarked emergency

spending). US Senators speak about a 'crisis' but that is rubbish;

crafting new weaponry is so deeply rooted in the US society and

economy that this will survive for at least a year or two (may be

longer). The USA might give up the status of the US$, they might

give up this and they might give up that. But they will never give

up crafting new weaponry, that detail was already understood by me

in Oct 2001... Here is the Reuters fun:

http://www.reuters.com/article/marketsNews/idUSN0340101120080603?sp=true

And for the main dish:

When oil was before 120 US$ a barrel I

promised OPEC to update before it would breach 140. This is the

update.

Last Friday the DOW Jones plunged almost 400

points while the price of a barrel of crude oil shot up almost 11

US$. So if there is any idiot left still saying that US investors

have nothing to do with the price of oil, commodities and food;

let this idiot stand up so we can identify you and kill you.

OPEC has been right all these years;

speculators are a big hinder for the normal evolution of prices in

regard with supply and demand for the wide array of oils there

are. From light sweet crude to heavy sour oil; the Western

economists know that we have to blame India and China.

But now these Western academics are standing

in their underpants; an oil hike of almost 11 US$ has never been

observed before...

And OPEC has to understand that these Western academics tell the

same crap about food: it is China's hunger for meat that is to

blame...

In the meantime countless millions can't buy rice let alone meat.

I hope that the best investment that OPEC can

do right now is to keep the oil below the surface so future

generations can have some kind of life.

Weighing all in all I would say: No need to

pump up more oil. Better think of a relatively large third oil

market beside the two in the USA and Europe. And spread happiness

around the world, spread happiness instead of US weaponry

around.

Till updates.

(06 June 2008) Today we will look of course at

the Federal Reserve Z1 release that came out yesterday. But first

we have some fun:

Only yesterday I mentioned that under the

Dubya regime the Americans can't even pay for their road maintenance

and today a Media report popped up on the Drudge report. I knew it

was bad but that it was this bad already is of course perfect

news; more and more the USA starts to look as some former

communist republic...

Here

is the usatoday fun.

Now for the serious stuff: US debt growth of

the entire financial sector. As you can see in the table below the

debt of the US financial sector on herself is over one gross

domestic product. In the third column you see the Q on Q growth

and if you would annualize these figures you see that debt growth

in the financial sector is always a multiple of the gross domestic

product growth.

| USA,

outstanding debt all financial sectors. (source) |

| Y and Q |

Total debt in bn |

Q on Q % change |

New debt needed Y on Y |

| 2006 Q3 |

13841.4 |

1.71% |

971.7 bn US$ |

| 2006 Q4 |

14153.7 |

2.26% |

1321.2 bn US$ |

| 2007 Q1 |

14469.7 |

2.23% |

1336.1 bn US$ |

| 2007 Q2 |

14819.2 |

2.42% |

1484.4 bn US$ |

| 2007 Q3 |

15406.2 |

3.96% |

2589.9 bn US$ |

| 2007 Q4 |

15745.3 |

2.20% |

1432.7 bn US$ |

| 2008 Q1 |

15945.7 |

1.27% |

827.4 bn US$ |

Since the debt in that part of the economy is

larger than an entire GDP you might think that the Americans have

a problem. Not some small problem but a giant problem in that

sector of the economy only...

So not the Americans; no financial journalist over there writes

upon such boring stuff. You will never find it in the minutes of

the Federal Reserve. But in fact it will break their military

might, this is obvious. It is also obvious that this happened

under the Dubya years of ruling America. For Dubya the economy is

easy to understand: All that matters is that people have money in

their pockets... Real money on the back of wealth creation or

borrowed money, to Dubya it is irrelevant.

Most Americans are relatively stupid and

think that the credit crisis is only something that is somehow

related to sub prime mortgages. Yet sub prime was only the weakest

link; the credit crisis is a big big squeeze on credit

availability.

When mid 2007 the credit crisis broke out, in

the last column you can see it's effect on debt growth in the US

financial sector. Now we have the 2008 Q1 figure in you see debt

growth was still 827.4 billion US$. If you withdraw this from the

total profits in the US financial sector you likely end up with a

negative figure. And this has been going on for many years.

All those who have large amounts of

outstanding debt still don't get it: Most of the outstanding debt

will never be paid back... If you think otherwise, please explain

how the combined US financial sector is going to pay back this 16

trillion?

We close the day with a quote from the Winter

blog:

All truth passes through three stages. First, it is ridiculed. Second, it is violently opposed. Third, it is accepted as being self-evident. - Arthur Schopenhauer (1788 - 1860)

Till updates.

(05 June 2008, temporary update) I did some

thinking on the previous update, I did some typing on my

calculator and I arrived at a possible second explanation about

the one trillion collateral as absorbed by the US FED:

It might well be this is only a cumulative

number. And when you look a bit at the money streams in the other

programs this is the most likely explanation.

On the one hand this is a pity but on the other hand total

combined real reserves of the US commercial banks is 130 billion

in the negative right now. And who does not like the concept of

banks having negative real reserves and positive borrowed reserves?

It is a bit like a US citizen who borrows 10 thousand US$ from the

bank giving his SUV as collateral and after that says his savings

are 10 thousand US$...;)

Lets get serious: Tomorrow we have another Z1

release and I am waiting for weeks already. After all last

year I calculated that the US financial sector as a whole needs

2500 billion more debt in order to stay profitable in 2008. So

tomorrow is a very interesting day on that detail.

In another development in the Iraqi equation the

present US government tries to get 50 military bases, control of Iraqi airspace and legal immunity for all American soldiers and contractors.

So enemy combatant Dubya still tries to get the oil...

It is definitely worth an investigation: Is Dubya indeed the most

stupid US president ever? And, if confirmed, is the US population

also stupid because they not only voted once but twice for this

guy?

Ha, the stupid Americans! They never saw the housing crisis

coming, their roads are beyond repair because of lack of money and

the US financial system is the same mess as Iraq. Welcome to the

heritage of Dubya; the guy will be a long long footnote in history

about how not to run a world power...

Here

is the independent file with the secret Dubya plan.

In the funny news department the DOW soared

over 200 points on retail sales (read more inflation) and labor

news (read insignificant news because of it's volatility).

Let me quote some retard named Goldman (source),

quote:

Alfred E. Goldman, chief market strategist at Wachovia Securities, contends the market is entering a stronger period because of investors' ability to not overreact to some bad news such as rising oil prices and a weak dollar and to focus instead on the retail sales and jobless claims numbers.

"What investors are doing is looking beyond the valley to the peaks ahead," he said. "The big picture is that we're in a market that's transitioning from a bear to a bull."

The Dow rose 213.97, or 1.73 percent, to 12,604.45.

It looks like the DOW traders get more and

more desperate because the next file found states that

foreclosures are still on the rise with more fun to come. Lets

quote some statistical fun (source):

In fact, Americans' equity in their homes -- usually their single biggest asset -- now has dropped to the lowest level on record in figures going back to the end of World War II. Homeowners' portion of equity fell to 46.2 percent, which means the amount of debt tied up in their homes exceeds the equity they have built up.

Comment: If this goes back to World War II

you can bet on it that HELOC loans are not included therefore a

35% figure is far more realistic. If it truly would be 46.2% we

would not have, quote from the same source:

The report also found that more homeowners slipped behind on their monthly payments. The delinquency rate jumped to 6.35 percent -- or 2.87 million loans -- compared with 5.82 percent for the previous three months. Payments are considered delinquent if they are 30 or more days past due.

Comment: I still am living in a dream world

and still there is no statistical detail observed that will

prevent the destruction of the US military might. Ok there will be

some stubbornness before the Americans start creating wealth from

work again, but that is their problem and my fun...;)

Till updates.

(03 June 2008, on 05 June added the second

explanation, see below) Today I viewed some very funny

news and I studied some real serious stuff. Lets start with the

fun department:

The US Federal Reserve chairman Bernanke told

his audience via satellite that he was worried on inflation... And

he tried to sound hawkish...

I almost fell from my chair from laughter,

the idiot Bernanke has lowered rates so far that real rates are

negative. This induces a 'cash is trash' mentality and thus the

oil, food and commodity markets are flooded with money driving up

everything with an absurd speed. And after that this idiot comes

telling he is worried about inflation...

We finally have proof: Bernanke is indeed a

clone of Alan Greenspan!

Title:

The Clone worries...

__________________________

And from the department of serious affairs we

have:

Just a few days ago I informed you that I did

not understand much about what was happening at the New York FED.

In just a few days my knowledge has increased by a lot because I

came across this article from Barry Ritholz. Here is the article:

http://seekingalpha.com/article/79727-the-fed-credit-crisis-inflation

I consider Barry the best writer on the

entire Seeking Alpha dot com, but being the best writer on that

website is not a very great achievement since most writers over

there are rather amateurish. So not Barry. And, just like me, he

loves math. His graphics are always a jewel for the eye and he is

a good writer too.

In short: For me Barry as an individual has more credit than the

whole Federal Reserve & he also has more brains than the

combined US Central Bankers...

When Barry gets interviewed by stupid media

folks he is Mr. Polite himself and when you read what he writes

you hear the lion roar.

Where I as a dumb person thought that the FED

had only pumped about 150 billion US$ via three programs that I

follow, Barry placed the next link to the New York FED:

http://www.newyorkfed.org/markets/Forms_of_Fed_Lending.pdf

And thus there are not three but five

new programs of taking in thrash from banks (AAA grade investment

stuff, often mortgage backed stuff but also car loan and student

loan related stuff). But most of all, quote:

Further, the OpEd notes that the Fed has -- at least so far -- staved off a total financial meltdown through their alphabet soup of credit facilities, lending nearly a trillion dollars to banks and brokers against all sorts of sketchy collateral.

Comment: So why is this trillion not reported

in the FED H3 file that is supposed to track those 'providing

liquidity' programs? (See http://www.federalreserve.gov/releases/h3/Current/)

There are two possible explanations:

--ONE) That is because in H3 only the Basel one rules are tracked and

hence the missing 850 billion US$ have to go to the so called 'off

balance' items from the commercial and investment banks.

Only somewhere next year Basel two will set in and off balance

items need to count for the reserves of banks too, rather likely

we will hear from 'technical difficulties' in 2009 when it comes

to implementing Basel two...

--TWO) The mentioned one trillion could be a cumulative number

over all five programs over the entire lifespan. This could be

because the money auctions (the TAF program) is about 600 billion

US$ cumulative.

Title:

So in fact, this already could have

happened...

At last I want to make an easy to understand

calculation as why it is so stupid to leverage up all that stuff.

It is about investment bank Lehman Brothers, right now they are

leveraged up something like 27.1 and in some time it is 25.

How does it work?

Lehman Brothers takes 10 US$ million from

it's on balance books and places it in the off balance files. With

a leverage of 25 they borrow 240 million US$, this gives a war

chest of 250 million US$ to hang out the 'investor'.

When those investments decline only 4% they have lost 10 million

from the war chest so they are left with 240 million US$.

You understand: All of the original on balance money has been

lost.

But there is no problem: After all we have left 240 million, why

not take out 5 million and with a leverage of 50 we borrow another

245 million US$ from the same pool of sucker investors?

And so on and so on, this explains why the

leverages only climbed all those years until the credit crisis

broke out. And if Barry is right with the detail that the US FED

has taken one trillion of that shit on her balances; why invest in

the USA???

Title:

Till updates, have a nice life or try

to get one!

(02 June 2008) Man oh man, today I found a

wonderful graphic that paints some giant damage for the Americans

in general and future budgets for the US military in particular.

The graphic was found in an article on the economist dot com:

http://www.economist.com/world/na/displaystory.cfm?story_id=11453745

The article is relatively low class because

it does not say that US family housing value leaks away at a 10 to

12 billion US$ a day. Ok ok, the article says that the present

decline is bigger compared to all what happened during the great

depression. But for me that was old news.

Lets enjoy the graphic, it is from Robert

Shiller so it is one 100% reliable:

Title:

After waiting for over four years:

Here I come you fucking US military!

I don't recall how long ago I wrote that the

US military might will be destroyed more or less the same way as

they won the cold war with Russia, it could be 2004 or even 2003.

But I have been right all the time while the Americans only added

weight and more and more one yard wide ugly wives popped up on

their streets.

Do you know why Americans love one yard wide females? I don't know

why they love those one yard wide females but they have plenty of

them...

Brrr & bah! Disgusting are those one yard

wide wives. Till updates...;)

(30 May 2008) Today two things: One of the most

strange phone calls from my entire life and in the second part I

will try to explain that indeed total reserves of the US

commercial banks very well could be far below the official H3

report on this.

| But first, in case you

missed it: There is a new full blown

Military Bloody Day declared for the 26th of July, this

time mostly in Afghanistan and in case the security

situation has improved enough in Iraq, I hope on some good

US military coffin filling in Iraq also! Good luck to

those who will stage the attacks! |

Part 1) Over two months ago I went to a new

energy provider named Eneco, but the contract still isn't

validated so I phoned 0900 - 0201 to get to the consumer help.

At first you get one of those menu's with stuff like 'If you have

a question about your bill dial 2'. And lucky me: They female menu

voice also said that this conversation was recorded for training

purposes. So it's recorded...

After dialing through the menu the phone was

answered. (Phone call was done around 16.30 local time) The guy

said:

'Goedenmiddag Reinko, ik ben Censura on

Dominicus en waarmee kan ik u helpen?'

Translated this is:

'Good afternoon Reinko, I am Censura on

Dominicus and what can I do for you?'

My dear reader, don't you think it is a bit

weird that when you make your first phone call to your new energy

provider they already know your name? Lets leave it with that and

turn in the next part to the serious stuff (the destruction of the

US military).

Part 2) Lately the US Federal Reserve is

constantly 'providing liquidity' to the US financial system. Why

they do this I do not understand completely since the US investors

have plenty of money to pump up oil, food and commodity prices on

a global scale. (Look at the pdf file from 26 May; if you use the

reported oil data in there US index investors are driving up oil

prices 37.2% as a point estimate.)

The three 'providing liquidity' programs are:

1) TAF (Term Auction Facility),

2) PDCF (Primary Dealer Credit Facility) and

3) TCLF (Term Securities Lending Facility).

On 23 May I already argued that if the

garbage as collateral accepted by the FED is only worth 90

cents on the dollar, we already have one third of total US

banking reserves wiped away. To make my case that indeed the total

US financial system is under water we only look at the 'terms and

conditions' of these three programs.

Here we go, we look at details of the

accepted collateral of course:

1) TAF (source),

the detail that counts says that the local US Central Bank tells

what it's worth. Quote:

"Collateral value"

means, with respect to the assets pledged by a Participant to its

Local Reserve Bank, the value, as of the Bid Submission Date,

assigned by the Local Reserve Bank to such assets.

Comment: The local reserve bank estimates the

value.

2) PDCF (source),

the detail says it are the primary dealers like former Bear Stearn

Cos that define the value of the pledged collateral. Quote:

Eligible Collateral

Collateral eligible for pledge under the PDCF includes all collateral eligible for pledge in open market operations, plus investment grade corporate securities, municipal securities, mortgage-backed securities, and asset-backed securities. Collateral that is not priced by the clearing banks will not be eligible for pledge under the

PDCF.

Comment: Collateral that is not priced by the

clearing banks (the clearing banks support the primary dealers)

says it all.

3) TCLF (source).

The detail says that the New York bank tells what it is worth, but

the FRBNY uses two schedules and schedule 2 has 5 sub schedules.

Quote:

Eligible Collateral

In order to prevent securities lending from affecting overnight bank reserves, loans will be collateralized with eligible collateral rather than cash. Eligible collateral will be determined by the FRBNY and

includes (see the source).

Comment: I do not have a clue as what is

happening over there. It also raises questions about the

definition of 'cash' at the New York FRB...

__________________________

Weighing all in all it still is a bit strange

that the Americans have plenty of money to disrupt food and

commodity markets on a global scale while at the same time do

weird stuff like asking the primary dealers what the pledged stuff

is worth actually on 'the day it is pledged'. The PDCF is

definitely the most weird one but I completely do not understand

what TCLF is.

All we know 100% sure is not to invest in the

US financials.

Till updates, have a nice life or try to get

one!

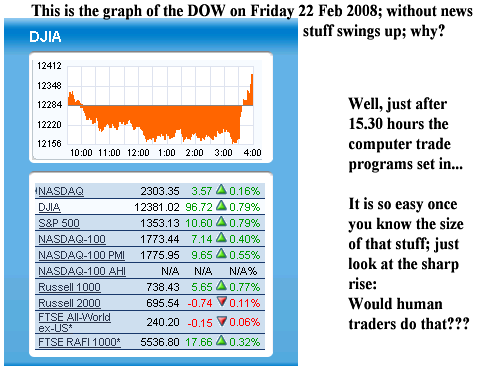

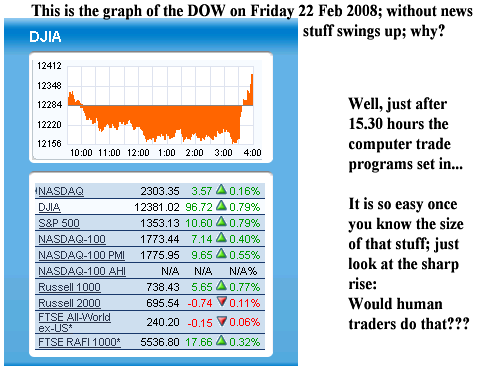

(28 May 2008) Two things today: The weird behavior of the DOW Jones and a

detail from Afghanistan.

--DOW Jones: Today it was reported that year

on year US family housing lost about 3000 billion US$ in equity (source)

and so US commercial real estate must also have had a solid hit in

the last 12 months. It was 14.4% down year on year while the US

government lately reported a 3.1% decline (source).

By the way, the US government uses data from Freddie Mac (that is

a bastion of solid accountancy reporting...)

US consumer confidence was at a 15 year low.

More and more car loans are under water and the stuff is even

spreading to second hand cars.

Yet the DOW climbed on the 'news' that new

home sales were up 3.3% but it was 'seasonally adjusted'. The US

commercial department did not say what the real figure was and

zero so called 'financial journalists' asked for the real figure.

In short: Given the news this was a day of

computer trading programs that only work with so called technical

analysis so all that negative news is simply neglected...

And thus the Wall Street traders could sit back all day long and

eat bread and meat.

--Afghanistan: After the lawful killing of

Dennis van Uhm, the son of the Dutch military leader general Peter

van Uhm, suddenly all reports of the Mujahedin being cowards have

suddenly stopped.

And although there are no Media reports on

this; suddenly it is in the mind of the local 'military experts'

that confronted with all this Dutch artillery and air power, the

Afghani fighters simply are far more brave compared to those Dutch

'fighters'.

Again I would like to congratulate the

Afghanis with this perfect and lawful killing of Dennis van Uhm.

Like stated so many years ago: If you help me I will help you...;)

For this year 2008 it was advised to the

Afghanis in the last year 2007 to try and kill about 10 to 20

Dutch military folks, this policy is still valid. Otherwise the

other NATO countries will not get the message that flows from the

lawful killing of Dennis van Uhm.

Weighing all in all: This year there will be

only one so called Military Bloody Day and it is located in the

heat of Summer: 26 July 2008.

It is mostly for the Afghanis but if the

Iraqis want to help also you won't hear complaints from me. After

all now the credit crisis has turned into a food crisis we have to

kill more Americans.

So let it be official:

Next MBD and

the proceeding 15 days too of course is located in time at

26 July 2008.

As far as I see reality, it will be the only

MBD of this year.

Till updates, think well and fight well.

(26 May 2008) Man oh man, I already suspected

pension funds for a long time of pushing up food and commodity

prices. Via the blog from Russ Winter I found some good

information that indeed validates my insights or my suspicions.

But it is all true: the policies of the weird

fool Alan Greenspan will kill countless millions in the future.

And I am sad, there are almost no Americans

killed while this is so important right now. Waiting for the US

Senate pushing for some legislation is like waiting for the US

highways to get repaired...

The light version of the info found is the

next:

http://wallstreetexaminer.com/blogs/winter/?p=1664

And on the U.S. Senate Committee on Homeland Security and Governmental Affairs

website you can find a 19 page pdf file that is definitely worth

saving to your hard disk. Try to grasp it's future consequences,

they make me sad. Here it is:

http://hsgac.senate.gov/public/_files/052008Masters.pdf

I am sad that nobody kills Americans for

this, why let the American pension funds kill countless millions

and there is no retaliation???

Lots of people still don't get it: Making dialogue with the

Americans is utterly dumb, killing is the answer. Please remark

that I am not responsible for the way the Americans behave, I have

no influence on US politics whatsoever, not in the past and not in

the future.

It is sad but killing that slime is the only

way.

Just a quote from page 8 of that file:

There are hundreds of

billions of investment dollars poised to enter the commodities

futures markets at this very moment.26

If immediate action is not taken, food

and energy prices will rise higher

still. This could have catastrophic economic effects on millions

of already stressed U.S. consumers. It literally could mean

starvation for millions of the world’s

poor.27

Remark: The US military needs a very skewed

populace with many poor (the trailer trash people) in order to

fill her ranks. But right now the military desire gives rise to

millions of distressed US folks and countless deaths on a world

wide scale.

Therefore once more:

Kill more Americans!

It is logical, it is morally ok. Why not kill

a few more of this slime?

Till updates.

(23 May 2008, corrected 25 May) According to the US Federal

Reserve it is only arithmetic that the non borrowed reserves

are negative, quote (source):

The negative level of nonborrowed reserves is an arithmetic result of the fact that TAF borrowings are larger than total reserves.

Therefore lets do some simple arithmetic

ourselves, remark that for long periods of time the total reserves

of the US commercial banks were 40 to 42 billion US$.

| Table of

death, source

(millions of US$) |

| Date |

Non borrowed reserves |

TAF money auctions |

Bond auction program |

| Nov 2007 |

42313 |

0 |

0 |

| 22 May 2008 |

-111855 |

125000 |

15401 |

Lets look at the 'arithmetic result' on 22

May:

125000 + 15401 - 111855 = 28546 million US$.

Thus life is easy to understand: Since Nov

last year about one third of the real reserves of the US

commercial banks have gone...

Of course it is not in the main stream news

since this news is bad for advertising income, let that be the

problem for the main stream journalists and not my

problem.

Correction: I

was forgotten that the FED had three programs to 'provide

liquidity' to the commercial banks and the primary dealers, look

in the source

file at the 'Primary' column under 'Other borrowings from the Federal Reserve, NSA'

where another 13+ billion is parked.

It's no problem; we only have to wait a few

months longer. Stuff like this simply has to run it's course.

Likely family housing value will decline another trillion this Q2,

lots of car loans are already under water because of rising fuel

prices, commercial real estate is declining faster and faster, the

option mortgages will reset two times this year, foreclosures are

still on the rise, housing inventory is still on decade long highs

and that guarantees further price declines. Level 3 assets are

still rising and so on and so on. It looks that the financial mess

in the USA is from the same level as the mess in Iraq, a great

achievement done by team Dubya! Ha, in these months you only have

to wait for what new 'AAA investment grade' collateral is accepted

by the FED and you know what next part is under water in this

lovely credit crunch...;)

So I am sorry I made a

mistake, but although the H3 report from the US Federal

Reserve does not reflect it; my guess is that total reserves of

the US commercial banks are indeed declining rapidly. And if the

accepted collateral by the FED is worth 90

cents on the dollar, we already have lost one third of

total reserves of the US commercial banks...

At last: The concept of 'borrowed reserves'

comes from the other side of the milky way from some weird

financial universe. If you would have won one million in a

lottery, would you bring that to a bank that lived on borrowed

reserves?

Till updates.

(19 May 2008, this is a more or less scientific

update so I dunno if it's temporary or not) From the high

mountains of advanced math I come thundering down to the green

valleys where the math dwarfs live.

This update is for the Wall Street traders

who all are math dwarfs by definition. I have found a YouTube vid

that even you can understand. It is about exponential growth and I

know you all get a severe headache only when you hear that word so

take some pain killers if you need them.

Here is the vid, please look at that elderly

American academic that explains exponential growth in a way that

even you folks can understand:

http://www.youtube.com/watch?v=F-QA2rkpBSY&NR=1

After you have seen the video you understand

that the American academic is only trying to explain how

exponential functions like f(t) = 1.07t behave.

In my world I would formulate it as this: Wow

wow wow, this American academic is capable of taking a product

integral from the constant 1.07! For an American this is just unbelievable

& also did you notice there were zero obese people in the

YouTube vid??? (Where did they hide them?)

Lets get serious: I want to destroy the US

military might and the most efficient way right now is doing that

via destruction of the US financial system. You Wall Street folks

rather likely think this is not a good idea.

So let me give you a few shots:

Shot 1) In the last seven years total debt of

the US economy upon herself grew about 8% a year, the FED never

had a problem with that because beside debt growth they also have

to 'finance' inflation and GDP growth.

Give it a bit of time my dear Wall Street

traders; 8% debt growth year in year out.

Shot 2) It is not in the main stream news

because most financial journalists are math dwarfs themselves, but

right now the total of debt that the US economy has upon herself

is over 50 trillion. Since 8% of 50 trillion is just 4 trillion

you folks need 4000 billion more debt this year, there is only one

little problem:

There is a so called 'credit crisis' going on.

Shot 3) This one I leave to the imagination

of the Wall Street traders; what would you publish as shot number

3 if you were in my shoes?

That's the end of this update, I am smiling

ear to ear because I cannot find any reason or any kind of data

set that will protect the US military from future finance withdrawal.

Till updates my dear math dwarfs, till updates.

(15 May 2008) Today the US President Dubya gave

a 'speech' in the Israeli Knesset (that's the Israeli parliament).

His speech writers (Dubya cannot write his own speeches) had done

their best:

God had given some promise to Moses, king

David and some more folks and the new created state of Israel was

the fulfillment of that promise. And the Israelis were 'God's

chosen people'.

After my humble opinion, when you have six

decades of war this rather likely is not a fulfillment of Gods

promise.

And Dubya praised the Israelis and held them

high as an example for the other 'terrorist supporting' nations in

the region. Yeah yeah Dubya, Israel is indeed a beacon for

freedom; over there Palestine females give birth at children at

military checkpoints because the fucking IDF won't let them go to

the hospital. Welcome in the land of the free Israelis... (Lets

hope the OPEC starts withdrawing a bit of oil from the two main

oil markets because I like oil a bit more higher please.)

Lets zoom in on the main contradiction in the

Dubya speech:

Dubya said that is was wrong that innocents

got killed while trying to achieve 'political objectives'.

Please my dear reader, let that one sink in;

when innocents get killed while trying to achieve political

objectives, Dubya considers that terrorism.

My dear reader, what is the highest

'political objective' in these centuries and decades? Isn't that

the creation of a state?

But then, what about all those Palestine villages that were wiped

off the map?

The Palestines were innocents in those days.

Elementary logic, with Dubya's own definition

of terror in my hands, says that Israel is founded with a massive

use of terror. And this explains why we still have so much terror

at the scene in the present days. But very likely Dubya will never

grasp that one; that's a pity for a lot of people.

Till updates.

(13 May 2008) In this world there are a lot of

holes where all long term stupidity has flown too. For example the

military regime of Myanmar is one of those holes with a lot of

stupidity: Because they refuse to accept foreign help they will

kill countless thousands.

Yet compared to the military regime of the

former Birma, I think the US Senate is capable of killing

countless millions. If the next quote is true than I have never

ever observed a part of government holding so much power and at

the same time is so utterly stupid. So utterly stupid and so much

lack of just the most elementary economical insights, compared to

the US Senate the Wall Street traders are true Albert Einsteins.

Don't believe me? Here is the quote (source):

Also Tuesday, the Senate voted 97-1 to direct President Bush to stop adding to the nation's strategic petroleum reserve. Some lawmakers feel that these shipments, which average 70,000 barrels a day, are pushing oil prices higher. The administration argues that that amount is a pittance compared to the 21 million barrels of oil the U.S. consumes each day.

Comment: In the first place it is global

demand that drives oil prices and in the second place it are the

actions of so called 'investors' that drive commodities up so

much. The implications are stunning: The US Senate does not

understand the damage Alan Greenspan did with his policies...

Wow, 97 to 1. They think that 70 thousand barrels a day is pumping

up the prices...

The Myanmar regime easily fits one thousand times in this hole of

stupidity.

The advice given: Kill

more Americans, the richer they are the better.

Till updates.

(11 May 2008) Via some relatively simple media

files I would like to guard you to 'where we are' in terms of the

credit crisis. The only thing left out is the 'leverage problem'

because no reliable media files or whatever info was observed.

We start with Russ Winter, Russ knows a lot

of stuff but his writings are always difficult to follow. Lately

US credit card consumer debt was about 2 to 3 times as high as so

called 'economists' expected.

Russ explains why it is so easy to understand

why credit card debt is climbing so fast, it is known as a Ponzi

scheme (inside a Ponzi financial unit, debt is so high that for

only paying the interest the unit needs to borrow more). Both USA

citizen Russ as Dutch citizen Reinko agree that the whole US

economy is a Ponzi scheme.

Here is the link:

http://wallstreetexaminer.com/blogs/winter/?p=1625

__________________________

Some of the machinations of the US Federal

Reserve are discussed by Gary North on goldseek dot com. Gary is

very pessimistic about all that swapping of US government bonds by

the FED to the primary dealers.

Ok, I can understand his fear because it took

the FED from 1914 to 2008 to build up something like 800 billion

in government bonds. And ok ok, in just a few weeks one third of

that reservoir is pumped into the primary dealers stuff.

But Gary forgets that the Federal Reserve has unlimited access to

more government bonds, they simply buy it from the US treasury...

I mean the reserves of the Social Security funds are also 'bought'

treasuries, there is no reason the Federal Reserve could do the

same.

The article from Gary contains important information about how the

US banks avoid down writings and that is the reason I place it

here.

Here is the link:

http://news.goldseek.com/LewRockwell/1210170240.php

__________________________

From a website named the dailyreconing dot

com I place a few more articles from different writers. They are

very far in their thinking but do not connect the dots on very

important issues.

For example: They report about the height of

the derivatives (only $164.2 trillion in Q4 2007) and at the same

time report stuff like the P/E ratio on the DOW industrials is

climbing fast but they do not connect the dots...

If you connect the dots you understand there is a 'killer

threshold' on the DOW and if the killer threshold is taken, the

whole 164 trillion derivate positions come thundering down.

Lets go from writer to writer:

1) Dan Denning reports that now the Federal

Reserve accepts credit card debt as collateral for both the money

auctions as the government bond swaps.

Here is the link:

http://www.dailyreckoning.com.au/us-fed-credit-card-debt/2008/05/05/

2) Dan Denning reports that so called 'Level

3' assets are growing in all five US investment banks. Dan thinks

it is 'bad news' while I know this is good news. In these days

Level 3 is the thrash bin of the banks. It goes more or less like

this:

Many years to late regulators forced banks into Level 1, 2 and 3.

Level 1 is the most easy to understand and sell while Level 3 is

the most complicated and therefore in these days most difficult to

sell financial 'products' (for example second order call options

on a collection of 15 baskets of securities who are backed by

derivatives on credit swap positions and some down to earth sub

prime mortgages in the UK and California).

Very likely you do not want to buy such

stuff...;) Yet similar kind of stuff is in the Level 3 of the

banks. Here is the link:

http://www.dailyreckoning.com.au/level-3-assets/2008/05/08/

3) Richard Daughty wrote some good stuff on

the total of derivative positions as hold by the US banks. For

myself speaking; Take a visit at the Basel based Bank for

International Settlements, it is a combined website for over 50

central banks. Go through the derivatives sections on that website

and you see: This is beyond belief.

Without any insult to the above mentioned

writers who do not have the fruits of their labors quoted but only

linked, here is a funny quote from Richard:

The report shows that the notional value of derivatives held by U.S. commercial banks has suddenly plunged by a whopping $8 trillion, which is (unbelievably) still only 5% of the total, and which merely takes the total down to the aforementioned-yet-still-staggering $164.2 trillion.

When I realized that $8 trillion is more than half of America's GDP, that is when I realized that "Houston, we seem to have a problem, as we are on fire, and we are tumbling out of control into the sun where we will soon be fried to a cinder."

Comment: Richard is a bit non scientific with

this, he should have stated that absurd large derivative positions

on relatively small assets are outside reality.

My dear reader, what do you think? When the USA has a Gross

Domestic Product like only 13 to 14 trillion and has derivative

positions like this, would you invest or would you withdraw

investments from the USA?

Here is the article from Richard:

http://www.dailyreckoning.com.au/derivatives-commercial-banks/2008/04/29/

Lets leave it with these five financial

articles, they are not from the Main Stream Media because it is

impossible to draw any insight from the Main Stream whatsoever.

CNBC, CNN and the Dutch based RTL7 all under perform in painting a

realistic picture.

That's it, have a nice life or try to get

one. Till updates.

(09 May 2008) Today I placed a new update

in the NightmareOnWallStreet files, here

it is.

For the rest we only look at the Lebanese

stuff:

The Hezbollah has to understand they have my

full support, I too do not understand why this government tries to

crack so hard on you. Does this Lebanese government not understand

that the Hezbollah is on the US list of so called terror

organizations?

And once you are on that stupid 'anti

America' list you can never leave it, just look at Nelson Mandela.

Nelson is still on that list...

And at the moment Hezbollah looses her

military might, the fucking Israelis will come in for the kill.

That is relatively easy to understand. What shit is in the minds

of the 'Western supported' Lebanese government?

Therefore the advice is as follows: Avoid a

political coup by all means but bring some real bad days or weeks

to the official Lebanese army.

Holy Moses, why is the political insight of

the Lebanese government running at the IQ 43 level? They have that

Israeli slime next to them and they try to wipe out the military

power of Hezbollah???

I do not understand why they try to rule via

stupidity, it is from the same stupid level as we have in the

former republic of Birma.

Till updates.

(05 May 2008, this may be a temporary update or

not). Is the Federal Reserve picking up more garbage while

providing 'liquidity to the markets'? I have argued on many

occasions that they do and if indeed this Yahoo file is correct we

have the next, (source)

quote:

The central bank last week announced new steps to aid with tight credit conditions by increasing the size of cash auctions to banks and allowing financial institutions to put up credit card debt, student loans and car loans as collateral for Fed loans.

Comment: Car loans a collateral for US bucks

(also loans...)? Very interesting, the world reserve currency

needs to absorb car loans on her balance sheets in order to

'provide liquidity'? The car loans stuff has of course a bit to do

with General Motors (see the previous update below).

Car loans on the balances of the Federal

Reserve??? Please my foreign investors who like to invest in the

USA: Is it wise to invest or is it better to withdraw?

Car loans on the balances of the Federal

Reserve???

Any idiot still investing in that country is

only asking for the big haircut.

That's it, till updates.

(02 May 2008) It was a lovely week on the

financial markets; when Central banks start contradicting

themselves we only have more and more smell of what I call 'the

endgame'.

Let me give you two examples of

contradiction:

1) The Bank of England promises to the UK

banks they will have full support, the support will be secretive

and only after 30 years the amount of support will be unveiled.

Contradiction: A few days later the BoE tells

the public that this whole credit crisis is a bit overblown and

that sub prime mortgage related losses might well be only 50% of

what the banks think themselves.

2) The US Federal Reserve told the public

that there is no recession at all because there was still 0.6%

growth of the US gross domestic product.

Contradiction: Only one or two days later

they told they will take in 50 billion more of 'investment grade collateral'

(read garbage) in exchange for US dollars. So in the next week the

combined real reserves of the US commercial banks is about minus

150 billion. (The FED says that is only arithmetic...)

__________________________

It is all so funny because finally the

journalists start complaining that you just cannot explain the way

the DOW Jones and similar stuff moves...

And that is true my dear RTL7 and CNBC

journalists; it is a long way to the Piccadilly circus I can tell

you that!

__________________________

Since the financial journalists have proofed

this week they are not worth their salary, lets zoom in on one

detail that speaks for the broad market:

This week it was reported that General Motors

had a loss of something like 3.3 billion. (Of course this loss was

related to their financial services arm.) And so the GM stocks

shot very high and so called financial journalists explained 'the

loss was likely not as big as expected'.

Of course the financial journalists forget

that there is over one trillion in derivates outstanding on GM.

(Only the credit default swaps are something like one trillion,

lets not forget the ordinary put and call options on GM.)

It is well known and well documented that JP

Stanley Bear Morgan sold this stuff without administering if it

was 'call' or if it was 'put'. (As long as we sell more 'puts' we

are ok because we are America...)

Of course 'put' is the danger of a collapse

of this one trillion joke on GM and therefore it is rather logical

that GM posts a large increase in their DOW value (meaning the

stock price climbs fast) when they report a loss.

Why is the GM example a detail to the

behavior of the entire market?

Just look what the DOW Jones did; it ended

above 13 thousand so this year there is only about 2 or 3 percent

loss on that index for this year.

I guess the DOW Jones is the safest place to

be if only a GM component has over one trillion in derivates

hanging over it...

That's it, have a nice life or try to get

one.

(30 April 2008) Today I feel the need to go for

a little ego trip, not for very long but I rejoice in the news as

it was found today.

What is the case?

Well I am very dissatisfied with the weird

behavior of the US stock markets and the DOW Jones in particular

lately. Therefore I quote from my own writings from 13 Nov 2007,

it was an estimate of how much equity in home value would be

lost... (source):

That

amounts to something like 7 to 7.5 trillion US$ / year or over 20 billion

US$ a day.

Comment: Since the 13 Nov publication was the

opening salvo for the NightmareOnWallStreet I did add some pure

propaganda in it. I am so sorry for mixing truth and lies, I

really am ...;)

What about the ego trip?

Ha, when you look at the Case Shiller housing

index for the first quarter, something like 6 trillion in US home

value will be lost this year. Some Washington think tank comes up

with the next (source),

quote:

The Case-Shiller data released yesterday indicate the rate of house price decline is accelerating. The 20-city index declined 12.7 percent over the last year, while the 10-city index fell 13.6 percent. However, the annual rate of price decline over the last quarter was 24.9 percent in the 20-city index and 25.8 percent in the 10-city index. At this rate of price decline, the excesses of the housing bubble will have largely disappeared by the end of the year. At the same time, the price decline implies an incredibly rapid loss of wealth. In real terms, the rate of price decline in the 20-city index would imply a loss of almost $6 trillion in real housing wealth over the course of the year, an average of $85,000 per homeowner.

Comment: The think tank is relatively good

because if the reported 24.9% 20 city index is correct it is

indeed something like 5.8 to 5.9 trillion. Yet they have a major

fault in their thinking: at this speed it will take more or less

one year longer for the US housing bubble to have disappeared. And

that is another 6 trillion in lost private home equity my dear but

stupid Wall Street traders!

__________________________

This year the so called 'option mortgages'

will jump to their real interest level, I have never studied the

size of that fun but it is definitely comparable to the problem

generated by the sub prime mortgages.

In the UK it was reported for the first time

in many years that house prices are declining too and although I

never wrote one word on it, This is important news too since the

UK is also a bit bubbled up.

And so on, and so on; let me say it one more

time:

The DOW will

hit 7000.

If you have any information contradicting

this, please give it to me.

So far for my ego trip, have a nice life or

try to get one!

Till updates.

(29 April 2008) Today the US Federal Reserve

will have a so called 'policy meeting' and it could be they lower

rates again... And by doing so force the pension funds to swap

many billions in government bonds to weird investments in food

stuff and so.

So long term investors like pension funds are

turned into day traders on food markets, welcome to the strange

world from Alan Greenspan & co. Some Swiss banks are even

advertising with this; they advertise with 'portfolio managers'

that manage 'pension money' and the advertising slogan is

'Thinking new perspectives'.

But 'Thinking new perspectives' leads to

countless millions who go down from two meals a day to only one.

Crafting more financial products will not help while there is

still far too much money in the system.

And who pumped all this destructive money

into the system? Yes yes yes, it is Alan Greenspan. The second

culprit is the ECB Jean Trichet who still has his M3 money growth

year on year growing above 10% while at the same time insulting

workers that they should keep their 'wage demands' low. In this it

has to be remarked that the US Federal Reserve stopped publishing

their M3 money growth in 2005 because 'No additional economical

insights are gained from this'.

It just keeps me wondering: Why do only so

little people see the dangers of pumping up so much money into the

real economy? And after that throw some cookies at some monkeys

(with this I mean the Dubya tax package relief of 600 US$ for

every US taxpayer, also known as the 'stimulus plan').

And about thinking new perspectives; suppose

every US taxpayer would not get a lousy 600 US bucks but 60

thousand or even 60 million...

Would it change the US economical situation just one quantum?

Till updates.

(24 April 2008) Today I would like to look at

two points; looking as why the US stock markets act so counter intuitive

and may be a new recipe for the future feast meal (here

is the index for the future feast meal). Here we go:

-- I do not post any longer updates on the US

stock markets because they behave that weird. And when you cannot

make logic of it you must stop commenting on it. Of course I

perfectly know why the US stock markets behave so weird: they are

slaves of the outstanding derivatives positions and if the US

stock markets at some point turn 'too low' the whole financial

structure will collapse while on other stock markets you only have

to wait for a so called 'rebound'.

I can try to explain this once more but I

found a superb article that explains a relatively large chunk of

the stuff involved. If you do not understand it, it is recommended

to save it to your hard disk and at a later point study it

further.

Please do not back down because of CDS stuff (CDS = credit default

swap, it is just another financial derivate but it is nice to know

that inside the USA there is 50% of world gross domestic product

outstanding of this stuff). Here is a quote from that file (GM is

general motors):

Another example. The market cap of GM is only about $11B. However, based on estimates in the CDS market, there are about $1 trillion in CDSs betting on GM and their bonds. Any change in GM's situation, will create a rippling effect in this $1T CDS community of GM.

And here is the link:

http://news.goldseek.com/GoldSeek/1208412360.php

Again: save it to your hard disk and study it

so you understand the erratic behavior of the US stock markets.

For other nations it is also of relevance to understand this

article because when you have to disinvest large chunks of money

you must have a solid story... Until the present day there are

still lots of central banks who do not understand the significance

of these insights.

--The second item: A new recipe? Yes I am

thinking about a rather simple fishsoup that can even be cooked in

the heat of Iraq and the mountains of Afghanistan. If I write it,

it will have the next title: Dennis 'Can I have some air support'

van Uhm fish soup. Problem is: I do not have a clue at to what

herbs and vegetables the Iraqis and Afghanis can use both. So the

local cooks have to deal with that problem and of course use their

own experience...

That's it but because Dennis is cremated

tomorrow in Beuningen we just have to post some (propaganda) fun

once more:

Title:

Do not worry my dear Dutch, below you

see only black and white trailer thrash that could not find a

normal job...

Till updates, have a nice life!

(22 April 2008, temporary update) Today the new

Dutch leader of the Dutch military forces was giving an interview

to the 'Media'. And ok ok, he took it like a man...

He took it like a man: The first morning in office it was reported

that his son was killed...

And we cannot deny this: Giving an interview like this proves that

general van Uhm is not a coward; That's a fact. But I cannot give

him my condolences, sorry man but with a police force like this in

Groningen I just cannot do this.

Yet, since Uhm is Dutch why not proceed in

the Dutch language? Here we go:

Volgens mijn inschatting is het maximaal 48

uur nadat het grafkistje van Dennis de grond is ingezakt (misschien

doen ze een crematie, dat weet ik niet) is het vet janken voor

onze dappere generaal. Ik denk: zaterdag ochtend. Ja, de zaterdag

ochtend is een goed beginpunt om te beginnen met janken...

Voor de rest heb ik slechts twee punten:

Punt één: De generaal van Uhm heeft zo zijn

gedachten omtrent het al dan niet toevallig zijn van de dood van

zijn zoon. De generaal beschouwt dit als puur toevallig en de

defensie top en de politieke mannetjes hebben ook deze mening.

Ok, die hebben we dan weer in de spreekwoordelijke broekzak...

Punt twee: In een nogal lang verleden heb ik

vrij uitvoerig geschreven omtrent het statistische detail dat in

Irak het zeer wel moeglijk is we inderdaad tegen meer dan tegen

één miljoen doden staan te kijken. Beide studies, hoewel heel

verschillend, waren toch vrij rigoreus: Hoeveel doden zijn er in

dit huishouden en is er wat bewijs daarvoor.

De allerduurste studie was iets als 50

duizend US$.

Echter ons klotenleger doet allemaal rare

dingen en zegt niet heel eenvoudig dat je toch makkelijk op de

begraafplaatsen van Irak de echte getallen kunt vinden?

Waarom zeggen jullie dat niet? Het is

namelijk zeer waarschijnlijk dat 'het' meer dan één miljoen

is...

En omdat jullie dat niet doen dwingen jullie

mij om de overlijdens advertenties omtrent de dappere Dennis als

toilet papier te gebruiken.

Het spijt mij dat dit moet maar natuurlijk

heb ik nagedacht omtrent de legale consequencies van dit gedrag:

de Nederlandse wet zegt dat het niet verboden is om krantenpapier

te gebruiken op het toilet...

Daar kan je het voorlopig mee doen mijn